A cash advance on a credit card is a short-term loan that allows cardholders to withdraw cash against their card's credit line. Cash advances are convenient and flexible options when one needs cash right away, but they generally come with additional fees and higher interest rates than typical credit card purchases. They can be obtained in several ways, including at an ATM, in person at a bank, or over the phone. It is important to understand the process and associated fees before taking out a cash advance to make informed financial decisions and avoid negative impacts on one's credit score.

| Characteristics | Values |

|---|---|

| Definition | A cash advance on a credit card is a short-term loan that allows cardholders to withdraw cash against their card's credit line |

| How to get it | At an ATM, in person at a bank, or over the phone |

| Grace period | No grace period, interest starts accruing immediately |

| Interest | Higher interest rates compared to regular purchases |

| Fees | Cash advance fees, which can be a flat rate or a percentage of the amount advanced |

| Credit score impact | Can negatively impact your credit score if not managed carefully |

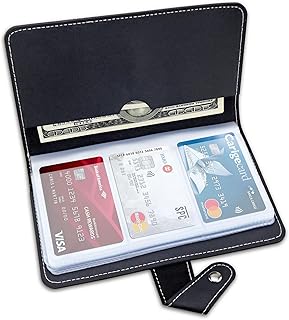

Explore related products

$7.59 $16.99

Cash advance fees

A cash advance on a credit card is a short-term loan that allows cardholders to withdraw cash against their card's credit line. While it offers flexibility and quick access to funds, it generally comes with additional fees and higher interest rates than typical credit card purchases.

Credit card companies typically charge a cash advance fee when cardholders use their card's line of credit to obtain cash instead of making a purchase. These fees can vary, but they typically range from 3% to 5% of the advance amount or $10, whichever is higher. In some cases, the fee may be a flat rate, a percentage of the transaction, or a combination of both. It's important to note that cash advance fees are separate from ATM or bank fees, which may also apply when taking out a cash advance.

The total cost of a cash advance includes both the fees and the interest rate, known as the cash advance APR. This APR is often higher than the APR for standard credit card purchases, and interest begins accruing immediately with no grace period. As a result, the longer it takes to repay the cash advance, the more expensive it becomes.

To illustrate the cost of a cash advance, consider an example where the credit card company charges a 5% fee with a $10 minimum, and the cash advance APR is 29.99%. If an individual takes out a $500 cash advance and repays it at $50 per month, they will end up paying $99.50 in interest and fees over six months.

While cash advances can provide quick access to funds, it's important to be aware of the associated fees and interest rates, which can make them a costly option. It's always a good idea to consult the credit card agreement to understand the specific rules and fees associated with cash advances.

The Supreme Court's Role: Interpreting the Constitution

You may want to see also

Interest rates

A cash advance on a credit card is a short-term loan that allows cardholders to withdraw cash against their card's credit line. While cash advances can be a convenient way to quickly access funds, they typically come with additional fees and higher interest rates than standard credit card purchases.

The specific interest rates for cash advances can vary depending on the credit card issuer. Some cards may offer lower cash advance fees and more competitive interest rates, so it is important to compare different cards before taking out a cash advance. Additionally, the method used to obtain the cash advance may impact the interest rate. For example, using an out-of-network ATM to take out a cash advance could result in additional fees.

It is crucial to carefully consider the potential costs and risks associated with cash advances before taking one out. Cash advances can negatively impact your credit score if not managed carefully, and the accruing interest can lead to a cycle of financial strain. Personal loans, borrowing from friends or family, or using a low-interest credit card may be more cost-effective alternatives to consider.

While cash advances can provide quick access to cash, the high interest rates and fees associated with them can make them a costly option. Therefore, it is recommended to consult your credit card agreement and consider all your options before taking out a cash advance.

Who's Next in Line? The US Constitution's Succession Plan

You may want to see also

Pros and cons

Pros of a cash advance on a credit card:

A cash advance on a credit card can be a quick and convenient way to get money when you need it. It can be a good option if you are short on funds and unable to charge an expense. It offers flexibility, especially when you need to make a cash-only payment.

Cons of a cash advance on a credit card:

Cash advances on credit cards typically come with additional fees and higher interest rates than standard purchases. There is usually no grace period, so interest begins accruing immediately, which can lead to a quick build-up of debt. There may also be limits on the amount you can withdraw, and the transaction fees can be a flat rate, a percentage of the overall advance, or a combination of both.

Before taking out a cash advance on a credit card, it is important to consider all your options and understand the associated costs, including interest and fees. It is also a good idea to consult your credit card agreement to be aware of the rules and potential impact on your credit score.

The Time It Took to Draft the Constitution

You may want to see also

Explore related products

ATM withdrawals

A cash advance on a credit card is when a cardholder uses their card to withdraw cash against their credit line. One of the most common ways to do this is through an ATM.

To withdraw cash from an ATM using your credit card, you will need to set up a PIN number beforehand. You can then insert your card at the ATM, enter your PIN, and follow the instructions on the screen. It is important to note that not all ATMs will allow you to withdraw cash using a credit card, and there may be additional limits on the amount you can withdraw.

Withdrawing cash from an ATM using a credit card is considered a short-term loan and can be very expensive. There are often substantial fees associated with this type of transaction, including ATM fees and cash advance fees. The interest rates on cash advances are also typically higher than those for standard credit card purchases and begin accruing immediately.

Before using your credit card to withdraw cash from an ATM, it is important to understand the fees and interest rates associated with the transaction. Check your credit card's terms and policies to find out the credit limit and fees for cash advances, as well as the current interest rate. Consider alternative options, such as a balance transfer to a card with a 0% APR promotional rate, as cash advances should generally only be used for emergencies.

Ottoman Empire's Constitutionalism: A Historical Governor's Analysis

You may want to see also

Other transactions

While cash advances are typically associated with withdrawing cash from an ATM using a credit card, there are other types of transactions that may be classified as cash advances by credit card issuers. These include:

- Money transfers through wire transfers or peer-to-peer (P2P) apps: Transferring money to friends and family through apps like PayPal and Venmo may be considered a cash advance.

- Payments for debts and loans: Using a credit card to pay off debts such as car loans, student loans, or other types of personal loans may be categorized as a cash advance.

- Foreign currency exchange: Exchanging dollars for foreign currency or obtaining traveller's cheques for international travel could be considered a cash advance transaction.

- Lottery tickets and gambling: Credit card issuers may classify the purchase of lottery tickets, casino gaming chips, racetrack wagers, or online betting transactions as cash advances.

- Cryptocurrency: Buying cryptocurrency with a credit card may also fall under the cash advance category.

- Prepaid cards: Loading money onto prepaid cards or similar cash-like transactions could be considered a cash advance.

- Monthly bills: Paying monthly bills, such as auto loans, with a credit card may be categorized as a cash advance by some issuers.

It is important to note that the classification of these transactions as cash advances may vary depending on the credit card issuer. It is always a good idea to check with your specific credit card issuer to understand their policies and which transactions they consider as cash advances.

Key Criteria for US Judges: Constitutional Requirements

You may want to see also

Frequently asked questions

A cash advance on a credit card is when a cardholder uses their card to withdraw cash against their card's credit line.

Cash advances on credit cards can be convenient if you need cash right away. However, they typically come with fees and higher interest rates than standard purchases, and there is no grace period before interest starts accruing.

Examples of transactions that may be considered cash advances include withdrawing cash from an ATM, transferring money via apps like PayPal and Venmo, paying monthly bills with a credit card, and peer-to-peer payments.

Some alternatives to consider are getting a loan from a bank, borrowing from friends or family, taking out a personal loan, or using a low-interest credit card or one with a promotional 0% APR offer.

![Wallet for Men - RFID Blocking [Functional & Practical] Bifold Slim Minimalist Credit Card Holder Pop Up Metal Case with Cash Slot, Front Pocket with ID Window, Gift Boxed (BLACK)](https://m.media-amazon.com/images/I/71CX-tkvR7L._AC_UL320_.jpg)