Policy delivery refers to the process of formally presenting and transferring an insurance policy to an insured party. This typically involves delivering the policy directly to the applicant, either by mailing it to them or having an agent hand it over in person. However, simply mailing the policy to the agent does not constitute policy delivery as it does not complete the essential step of transferring the policy to the insured individual. Therefore, when considering which of the following do not constitute policy delivery, the answer is policy mailed to agent.

| Characteristics | Values |

|---|---|

| Policy mailed to agent | Does not constitute policy delivery as it does not involve the final delivery to the insured |

| Policy issued with a rating | Does not constitute policy delivery as it does not equate to delivery to the applicant |

| Policy mailed to applicant | Constitutes policy delivery |

| Policy delivered to the applicant by the agent | Constitutes policy delivery |

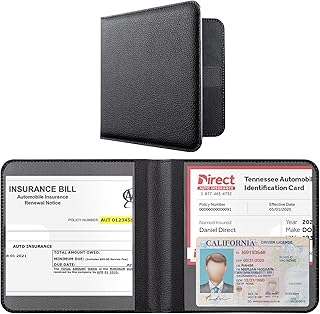

Explore related products

What You'll Learn

Policy mailed to agent

In the context of insurance, policy delivery refers to the process of providing the insurance policy documents to the policyholder or applicant. It is the final step in the purchase process, where the policyholder receives the document outlining their coverage details and obligations. Policy delivery is a crucial step in the insurance process, as it represents the moment when the policyholder gains access to the contractual agreement of their coverage.

Mailing the policy to the agent, rather than directly to the applicant, does not constitute policy delivery. This is because policy delivery must involve the policyholder receiving the documents directly or through their agent. In this case, the policy is sent to the agent, and there is no guarantee that it will reach the applicant. Therefore, it does not fulfil the criteria for policy delivery.

However, if the policy is mailed to the agent for processing and the agent then delivers it to the applicant, this would constitute policy delivery. This is because the policy has ultimately reached the intended recipient, either directly or through an agent. This scenario ensures that the applicant receives the documents and understands their coverage.

It is important to differentiate between policy delivery and underwriting activities. Policy delivery focuses on the actual provision of documents to policyholders, while underwriting involves evaluating risk levels and assigning a rating before the policy is delivered. Policy delivery processes are regulated and defined within the insurance industry to ensure that policyholders receive their documents in a clear and timely manner.

Enumerated Powers: Understanding the Limits of Government

You may want to see also

Policy issued with a rating

In the context of insurance, policy delivery refers to the process of transmitting the physical document of the policy contract from the insurer to the policyholder or applicant. This can be done through various methods, such as mailing the policy to the applicant or the producer, or having it delivered by the producer.

However, a "policy issued with a rating" does not constitute policy delivery. This option refers to the underwriting process, where the insurer evaluates risk levels and assigns a rating to the policy based on its risk factors. It is an internal procedure that occurs before the actual policy is delivered to the applicant or producer. The rating indicates the risk assessment or premium rating of the policy but does not imply that the policy has been delivered.

For example, if a person purchases car insurance, receiving the physical policy document in the mail is considered policy delivery. On the other hand, the process of assigning a rating to that car insurance policy is not policy delivery, as it is a step that takes place before the policy is issued and delivered to the customer.

In summary, "policy issued with a rating" does not constitute policy delivery because it refers to the classification and evaluation of the policy's risk factors, rather than the act of delivering the policy document to the policyholder or applicant. Policy delivery specifically pertains to the methods and processes of providing the policy to the intended recipient.

The Missing Democracy: Constitution's Omission Explored

You may want to see also

Policy mailed to applicant

In the context of insurance, policy delivery refers to how an insurance policy is provided to the policyholder. It signifies the final step in the purchase process when the policyholder receives the document that outlines their coverage details and obligations.

Mailing the policy to the applicant is a valid method of policy delivery. This involves sending the actual policy document to the person who will be insured, and it is considered a direct method of delivery. It is a standard form of delivery and is one of the ways of ensuring that the individual understands their coverage and has the documents in hand.

Policy delivery processes are regulated and defined within the insurance industry, ensuring that policyholders receive their documents in a clear and timely manner. The insurance industry's definitions clearly differentiate between policy delivery and underwriting activities, with policy delivery focusing on the actual provision of documents to policyholders.

Policy issued with a rating does not constitute policy delivery. This option refers to the underwriting process in insurance where a policy is assigned a rating based on the level of risk. It does not denote the transmission of the policy to the applicant and is instead an internal procedure before the actual policy is delivered.

What Exactly is Buzz Marketing?

You may want to see also

Explore related products

Policy delivered to the applicant by the agent

Policy delivery is a crucial step in the insurance process, referring to the method by which an insurance policy is provided to the policyholder. It is the final step in the purchase process, ensuring the policyholder receives their documents and understands their coverage details and obligations.

An example of this would be a life insurance agent personally handing the signed policy documents to the policyholder. This ensures that the individual understands their coverage and has the documents in hand. This is a crucial differentiation from underwriting activities, which focus on the evaluation and categorization of policies rather than their delivery.

In the case of policy delivered to the applicant by the agent, the agent acts as a mediator, ensuring the policy reaches its intended recipient. This could also include scenarios where the agent receives the policy first and then delivers it to the client, or hands it directly to the applicant after printing. This direct interaction between the agent and the applicant is what distinguishes this method as a valid form of policy delivery.

Policy delivery protocols are well-established within the insurance industry, with standard practices dictating that the policy must be transmitted to the applicant for it to be considered officially delivered.

Texas Constitution's Fragmented Executive: Why So Broken?

You may want to see also

Policy issued with a binding receipt

In the context of insurance, policy delivery refers to the process of transmitting the actual physical document of the policy contract from the insurer to the policyholder or applicant. This is a crucial step in the insurance process, as it represents the moment when the policyholder gains access to the contractual agreement of their coverage.

A policy issued with a binding receipt is a form of policy delivery. When an insurance application is taken by a producer, they may issue a binding receipt to the applicant if no initial premium is submitted. The binding receipt serves as a confirmation that the insurer is bound to provide coverage as of the date of the application or medical examination, whichever is later. This is done to assure the applicant that they are covered while the application process is ongoing.

However, it is important to note that the binding receipt is not the final policy document. Once the application is approved and all requirements are met, the producer will deliver the official policy document to the applicant, along with collecting the initial premium. This is the moment when the policy is officially delivered and takes effect.

In some cases, the producer may collect the initial premium along with a signed health statement at the time of policy delivery. This indicates that the applicant has reviewed and accepted the terms and conditions of the policy. The producer should also explain any relevant information, such as the amount of commissions to be earned on the transaction.

It is worth mentioning that policy delivery protocols are well-established within the insurance industry. These protocols ensure that applicants receive their documentation directly, either through mail or personal delivery by the agent or producer. Proper policy delivery helps the insured individual understand their coverage and have the necessary documents in hand.

Executive Power: Why the Unmatched Authority?

You may want to see also

Frequently asked questions

Policy mailed to the agent. This does not count as delivery because the policy has not reached the insured party.

Issuing a policy with a rating does not count as delivery to the applicant, but it is a step towards it.

Policy delivery is complete when the policy is mailed to the applicant or delivered to the applicant by the agent.

Policy delivery is the process of formally presenting and transferring an insurance policy to an insured party.

![Policy & Politics in Nursing and Health Care [POLICY & POLITICS IN NURSING &] [Paperback]](https://m.media-amazon.com/images/I/41gQdt7ym7L._AC_UY218_.jpg)

![ESSENTIAL Car Auto Insurance Registration BLACK Document Wallet Holders 2 Pack - [BUNDLE, 2pcs] - Automobile, Motorcycle, Truck, Trailer Vinyl ID Holder & Visor Storage - Strong Closure On Each -](https://m.media-amazon.com/images/I/61px7jy3NmL._AC_UL320_.jpg)