Unemployment benefits in Ohio are calculated based on a percentage of an individual's total wages during a specific period, known as the base period. This base period typically refers to four consecutive calendar quarters. To qualify for unemployment benefits in Ohio, individuals must meet certain requirements, including being unemployed through no fault of their own, having worked a minimum number of weeks during the base period, and earning a minimum average weekly wage. The weekly benefit amount is generally calculated as a percentage of the average weekly wage during the base period, and it is essential to consider factors such as dependents and eligibility requirements when determining the final benefit amount.

| Characteristics | Values |

|---|---|

| Minimum weekly wage | $338 (2025) |

| Maximum weekly benefit | $600 (2025) |

| Maximum weekly benefit with no dependents | $530 |

| Maximum WBA with no dependents | $561 |

| Maximum WBA with 1-2 dependents | $680 |

| Maximum WBA with 3 or more dependents | $757 |

| Minimum average weekly wage with no dependents | $1,122 |

| Minimum average weekly wage with 1-2 dependents | $1,360 |

| Minimum average weekly wage with 3 or more dependents | $1,514 |

| Base period | The earliest four of the five complete calendar quarters before you filed your benefits claim |

| Work requirement | 20 weeks during the base period |

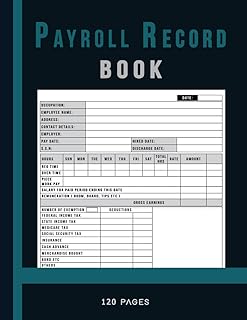

Explore related products

What You'll Learn

Base period

To qualify for unemployment benefits in Ohio, an individual must meet specific eligibility criteria, including being unemployed through no fault of their own, having a history of work, and meeting the state's requirements for wages earned during the "base period."

The base period is a critical component in determining eligibility for unemployment benefits in Ohio. It refers to a specific timeframe used to assess an individual's recent work history and earnings. In Ohio, the base period typically spans one year and consists of the earliest four of the five complete calendar quarters before the individual files their benefits claim. For instance, if an individual files a claim in August 2024, the base period would range from April 1, 2023, to March 31, 2024.

During the base period, an individual must meet certain requirements regarding their work history and earnings. Firstly, they must have worked for a minimum number of weeks during this period. In Ohio, this typically translates to working at least 20 weeks over the base period. Additionally, there is a minimum earnings requirement, which is determined by calculating the average weekly wage during the base period. For 2025, the minimum average weekly wage requirement in Ohio is set at $338. To calculate this average, individuals can divide their total earnings during the base period by the total number of weeks worked.

The base period is also significant in calculating the amount of unemployment benefits an individual may receive. In Ohio, the weekly benefit amount (WBA) is generally determined as 50% of the average weekly wage earned during the base period. For example, if an individual earned $40,000 during a base period of 48 weeks, their average weekly wage would be $833, resulting in a WBA of approximately $417. It is important to note that Ohio's WBA calculation differs from other states, as it considers the entire base period rather than just the highest-earning quarters.

Additionally, the base period can impact the maximum WBA an individual may receive. While the maximum WBA in Ohio is typically $600 per week, having dependents can increase this amount. The number of dependents and the average weekly wage during the base period are considered when determining the maximum WBA. For instance, with one or two dependents and an average weekly wage of $1,360 during the base period, the maximum WBA can be $680.

Understanding Circular Motion: Proving the Circle's Path

You may want to see also

Minimum wage requirements

To qualify for unemployment benefits in Ohio, there are specific requirements regarding minimum wage that must be met. Firstly, it is essential to understand the concept of a "base period." This refers to a specific timeframe used to assess your recent work history and earnings. In Ohio, the base period typically encompasses the earliest four out of the last five complete calendar quarters before you filed your benefits claim. For instance, if you submitted your claim in August 2024, the base period would range from April 1, 2023, to March 31, 2024.

During this base period, you must have earned a minimum amount in wages to be eligible for unemployment benefits. The specific minimum wage requirement in Ohio is an average weekly wage of at least $338 during the base period (as per the figures for 2025, which may change annually). To determine if you meet this criterion, you should divide your total earnings during the base period by the total number of weeks you worked.

Additionally, Ohio's unemployment benefits are calculated as a percentage of your average weekly wage during the base period. Specifically, your weekly benefit amount (WBA) will be 50% of your average weekly wage. This calculation is unique to Ohio, as other states may only consider one or two of your highest-earning quarters. It's important to note that the maximum WBA in Ohio is typically $600 per week (as of 2025), but this amount can be higher if you have dependents.

If you have no dependents, the maximum WBA is generally $561, provided you had a minimum average weekly wage of $1,122. With one or two dependents, the maximum WBA increases to $680, but you must have earned a minimum average weekly wage of $1,360. For those with three or more dependents, the maximum WBA is $757, requiring a minimum average weekly wage of $1,514. These figures highlight the correlation between your previous earnings and the amount of unemployment benefits you can receive.

It is worth noting that unemployment benefits in Ohio are subject to taxation. However, you have the option to defer the taxes until the end of the tax year when you file your tax return. By doing so, you can maximize your weekly benefit payments. Additionally, if you earn any income while collecting unemployment benefits, it is mandatory to report these earnings when filing your weekly claim.

Slavery's Constitutional Legacy: Examining America's Founding Documents

You may want to see also

Maximum benefit amounts

In Ohio, the weekly benefit amount (WBA) is calculated as 50% of the average weekly wage during the base period. This is different from other states, which may only consider one or two of the highest-earning quarters.

The base period is typically the earliest four of the five complete calendar quarters before you filed your benefits claim. For example, if you filed your claim in August 2024, the base period would be from April 1, 2023, through March 31, 2024.

To calculate your WBA, you must first determine your average weekly wage during the base period. This is done by dividing your total base period wages by the number of weeks worked. For example, if you earned $40,000 and worked 48 weeks, your average weekly wage would be $833, and 50% of this would be $417.

The maximum WBA you can receive each week is up to $600 as of 2025, though this amount changes annually. If you have dependents, you may be entitled to a higher benefit payment of up to $757 per week, provided you meet the minimum average weekly wage requirement. For instance, if you have three or more dependents, you must have a minimum average weekly wage of $1,514 to claim the maximum WBA of $757.

It is important to note that unemployment benefits are taxable income, and you must report any earnings while collecting benefits when filing your weekly claim. Additionally, the length of time you can claim unemployment benefits varies, typically lasting up to 26 weeks or until you find another job. However, this duration can be extended during periods of high unemployment rates in the state.

Capital Punishment: Unconstitutional or Justified?

You may want to see also

Explore related products

Job loss through no fault of your own

To qualify for unemployment benefits in Ohio, you must have lost your job through no fault of your own. This means that if you were laid off, lost your job in a reduction in force (RIF), or were downsized for economic reasons, you would meet the requirements for unemployment benefits. If you were fired for reasons other than misconduct or good cause, you may still be eligible for benefits. For example, if you were terminated because you weren't a good fit for the job, you might still qualify. However, if you were fired for failing to perform your job duties or willfully violating company policies, you may be disqualified from receiving benefits.

To determine your eligibility for unemployment benefits in Ohio, the state will review your recent work history and earnings during a one-year "base period." This base period typically refers to the earliest four out of the last five complete calendar quarters before you filed your benefits claim. For instance, if you filed your claim in August 2024, the base period would be from April 1, 2023, to March 31, 2024. During this base period, you must have worked for at least 20 weeks and earned a minimum average weekly wage of $338 (as of 2025; this amount may change annually).

To calculate your weekly benefit amount (WBA) in Ohio, you need to divide your total earnings during the base period by the number of weeks you worked. Then, take half of that amount to determine your WBA. For example, if you earned $40,000 and worked 48 weeks during the base period, your average weekly wage would be $833. Half of that amount, $417, would be your WBA.

It's important to note that the maximum WBA you can receive in Ohio is typically $600 per week (as of 2025), but this amount may be higher if you have dependents. If you have no dependents, the maximum WBA is generally $530 to $561 per week. With one or two dependents, the maximum WBA increases to $680, and with three or more dependents, it further increases to $757 per week.

In addition to meeting the financial requirements, to be eligible for unemployment benefits in Ohio, you must be a resident of the state, actively seeking employment, and able to work. You should also be prepared to demonstrate your job search efforts and provide information about your previous employment and salary when applying for benefits.

The Constitution and Gun Background Checks: What's the Deal?

You may want to see also

Dependents

To qualify for unemployment benefits in Ohio, you must meet several requirements. You must have lost your job through no fault of your own, for example, if you were laid off, lost your job in a reduction in force (RIF), or downsized for economic reasons. If you were fired for cause, such as failing to perform your job duties or violating company policies, you may be disqualified from receiving benefits. Additionally, you must have worked for a certain period, typically referred to as the "base period," and earned a minimum amount in wages during that time. The base period is usually the earliest four out of the last five complete calendar quarters before filing your claim. For instance, if you filed in August 2024, the base period would be from April 1, 2023, to March 31, 2024. You must have worked at least 20 weeks during this base period and earned an average weekly wage of at least $338 (as of 2025; this amount changes annually).

Once you qualify for unemployment benefits, the amount you receive will depend on your previous earnings and whether you have dependents. In Ohio, your weekly benefit rate is typically 50% of your average weekly wage during the base period, up to a maximum of $600 per week (as of 2025). However, if you have dependents, you may be entitled to a higher benefit payment. This reflects the recognition that those with dependents have a greater financial burden and, therefore, a greater need for support during unemployment.

The presence of dependents can impact the calculation of unemployment benefits in several ways. Firstly, the number of dependents may directly influence the benefit amount. Each dependent may increase the benefit rate, providing additional financial assistance to support the claimant's household. Secondly, the age and relationship of the dependents may also be considered. For example, some states may have specific criteria regarding dependent children, such as their age or student status. It is important to note that states may have different definitions of "dependents" and varying criteria for including them in unemployment benefit calculations.

In addition to the number and type of dependents, other factors may also affect the benefit amount. For example, the state's unemployment rate may influence the duration of benefit payments. During periods of high unemployment, the benefit period may be extended beyond the typical 26 weeks to 39 or even 46 weeks. This extension provides additional support for those struggling to find employment in a challenging job market. It is worth noting that unemployment benefits are not tax-free, and taxes must be paid on the received benefits, impacting the overall financial situation of those with dependents.

When applying for unemployment benefits, it is essential to provide accurate and detailed information about your work history, earnings, and dependents. This information allows the state to determine your eligibility and calculate the appropriate benefit amount. You may be asked to provide documentation, such as tax return forms (W-2 or equivalent), to verify your previous employment and salary details. By understanding the specific criteria and considerations for dependents in Ohio, claimants can ensure they receive the correct amount of financial support during their period of unemployment.

John Locke's Influence on the US Constitution

You may want to see also

Frequently asked questions

The base period is the earliest four of the five complete calendar quarters before you filed your benefits claim. For example, if you filed your claim in August 2024, the base period would be from April 1, 2023, through March 31, 2024.

You must have earned at least a minimum amount in wages before you were unemployed. In 2025, this amount was $338 per week on average during the base period. This amount changes each year.

Your weekly benefit rate in Ohio will be 50% of your average weekly wage during the base period, up to a maximum of $600 per week (as of 2025). If you have dependents, you may be entitled to a higher benefit payment of up to $757 per week.