The Made in America label is a powerful marketing tool that appeals to consumers' nationalism and desire for high-quality products. It also carries an unspoken promise of job security for American workers. However, the rules for using this label are complex and often surprising. To use the Made in America label, a product must meet specific criteria outlined by the Federal Trade Commission (FTC). The FTC's definition states that a product must be entirely or virtually entirely made in the USA, with only negligible foreign content. This includes the product's total manufacturing costs, labour, and materials. The FTC provides examples and guidelines to help manufacturers understand the requirements, but there is no single bright line determining what all or substantially all means.

| Characteristics | Values |

|---|---|

| Final assembly or processing | Must occur in the United States |

| Ingredients or components | All or nearly all must be made and sourced in the U.S. |

| Country of origin label | Required by law |

| Foreign content | Negligible or no foreign content |

| Manufacturing costs | Tied to U.S. production vs. foreign sources |

| Domestic and imported parts | Must be disclosed |

| Fair labor practices | OSHA regulations protect worker rights and safety |

| Environmental benefits | Reduced overseas shipping emissions |

| Supply chain security | Less reliance on foreign production |

| Marketing | "Made in the USA" label may invoke feelings of nationalism and support for American workers |

Explore related products

What You'll Learn

The product's total manufacturing costs

The total manufacturing costs of a product are influenced by several factors, and these costs can vary significantly depending on whether the product is manufactured in America or elsewhere. Firstly, the choice of production location can significantly impact the overall cost of manufacturing a product. For instance, offshoring or nearshoring may be more cost-effective for labour-intensive products due to lower labour costs in other regions.

In the context of the United States, offshoring may include manufacturing in regions like South America, Europe, and Asia, allowing companies to leverage cost advantages, access raw materials, and utilise skilled labour specific to those regions. However, offshoring can also introduce complexities and risks to the supply chain, making it less reliable. Onshoring, or domestic manufacturing, can provide benefits such as reduced shipping times and costs, lower carbon footprints, and compliance with American labour laws, but it also comes with higher corporate tax rates and employee benefit costs.

The United States has one of the highest corporate tax rates globally, with an average federal-state statutory rate of 40%, which has not changed in decades. This makes it challenging for American manufacturers to compete on pricing with their international competitors. Additionally, employee-benefit costs, including healthcare and pension expenses, are significantly higher in the United States than in other countries. These costs have been increasing and contribute substantially to the overall manufacturing costs.

Other factors that contribute to the total manufacturing costs include tort costs, pollution-abatement costs, and energy costs. According to MAPI and NAM's analysis, U.S. manufacturers face a cost disadvantage in tort and pollution-abatement costs compared to their major trading partners. However, they found a slight cost advantage in energy costs.

Furthermore, the specific requirements for a product to be labelled as "Made in America" or "Made in USA" can impact manufacturing costs. To meet these standards, the final assembly or processing must occur in the United States, and all significant processing and nearly all ingredients or components must be sourced and made in America. The product should have negligible foreign content, and the FTC considers the proportion of total manufacturing costs tied to U.S. production versus foreign sources.

In summary, the total manufacturing costs of a product made in America are influenced by various factors, including production location, labour costs, corporate taxes, employee benefits, tort costs, pollution-abatement costs, energy costs, and the requirements to qualify for "Made in America" labelling. These costs can be higher in the United States compared to other regions, impacting the competitiveness of American manufacturers in the global market.

Founding Fathers' Constitution: A Debate Among Themselves

You may want to see also

Country of origin labelling

The FTC's definition of "Made in the USA" requires that a product be entirely or virtually entirely made within the United States. This means that all significant processing, ingredients, or components must be sourced and manufactured in the US, with only negligible foreign content. The final assembly or processing must also occur in the US.

Determining whether a product meets the "Made in the USA" standard involves evaluating the cost of manufacturing, including materials and labour, as well as the significance of any foreign components in the final product. For example, a product with minor imported components, such as a grill with knobs from Mexico, can still be labelled as "Made in the USA". On the other hand, a lamp with an imported base would not qualify, as the base is a significant part of the finished product.

Companies that falsely advertise or mislabel their products as "Made in the USA" when they do not meet the standards may face civil penalties and increased scrutiny from the FTC. To avoid such consequences, manufacturers may use qualified claims to clarify a product's origin, such as "Made in the US from Imported Parts". These claims provide additional transparency to consumers and help companies avoid violating FTC guidelines.

Knock-Knock Jokes: The Formula for Fun

You may want to see also

Domestic content requirements

The term "Made in America" is a powerful marketing tool and a source of pride for many consumers and businesses. However, the claim can be misleading if not used correctly, as it is not always clear what constitutes a product being truly "made in America." The key factor is the domestic content requirement, which refers to the percentage of a product's total value that must be derived from US-based sources. This includes all aspects of production, from the origin of raw materials to the final assembly.

The Federal Trade Commission (FTC) is the primary regulatory body governing claims of American-made products. According to the FTC's Enforcement Policy Statement on U.S. Origin Claims, a product must be "all or virtually all" made in the US to be labeled as "Made in USA" or "Made in America." This means that all significant parts, processing, and labor must originate in the US, allowing for only a de minimis amount of foreign content. This de minimis rule generally permits a product to contain up to 5-10% of foreign content, depending on the specific circumstances, without disqualifying it from being labeled as Made in America.

The "all or virtually all" standard set by the FTC is intentionally stringent and challenging to meet. It is based on the overall product and not just the final assembly or processing. This means that even if the final product is assembled in the US, if most of its parts or significant processing occurred overseas, it may not qualify. This standard also applies to each individual product, so a company cannot average the domestic content across its entire product line.

To ensure compliance with the FTC's standards, businesses should carefully review their supply chains and manufacturing processes. This includes verifying the origin of raw materials, tracking the percentage of US content in components, and ensuring that any foreign content is minimal and necessary. Businesses should also be prepared to substantiate any claims with clear and accurate records, as the FTC can take action against companies making false or misleading origin claims.

Ultimately, the "Made in America" label is about transparency and providing accurate information to consumers. By understanding the domestic content requirements and carefully reviewing their supply chains, businesses can ensure they are complying with FTC standards and providing truthful information to their customers. This not only helps consumers make informed decisions but also promotes fair competition and supports the integrity of the "Made in America" brand.

In summary, for a product to truly be considered "Made in America," it must meet strict domestic content requirements, with most, if not all, of its parts, processing, and labor originating in the United States. Businesses aiming to market their products as such should be diligent in their supply chain management and record-keeping to ensure compliance with FTC regulations and to uphold the integrity of this powerful label.

Constitution Day: Denmark's National Holiday and Celebration

You may want to see also

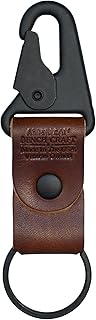

Explore related products

$19.98 $27.99

$35.99 $41.99

Worker protection and fair labour practices

The FTC's definition of "Made in the USA" requires that a product labelled as such be entirely or virtually entirely made in the United States. This means that nearly all parts, materials, and labour should originate in the U.S. The FTC considers the total manufacturing cost attributed to U.S. production versus foreign sources, as well as the significance of any foreign components in the final product. For example, a barbecue grill made of components made in the U.S. with the exception of the knobs may be called "Made in the USA", whereas a lamp with an imported base would not qualify, as the base is a significant component.

The FTC also evaluates the cost of manufacturing, including materials and labour. In some cases, even if foreign processing or parts make up a small portion of the total manufacturing costs, they may represent a significant amount of the overall processing. For example, a watch produced in the U.S. with mostly U.S. parts may use foreign-made movement components, which are essential to the watch's function. Therefore, an unqualified "Made in the USA" claim would be deceptive.

The "Made in America" label is associated with marketing and operational benefits, such as appealing to certain buyers and lowering shipping costs. It also indicates a commitment to safe labour practices, including supporting fair wages and safe working conditions. U.S. manufacturers follow strict labour laws, ensuring worker protection.

By choosing products made in America, consumers can support fair labour practices and worker protection. This includes ensuring that workers receive fair wages and benefits, as well as safe and secure jobs. American-made products also contribute to job creation and support local economies.

IRS Collection Activities: What Constitutes Action?

You may want to see also

Environmental impact

The environmental impact of buying products made in America is a complex issue, but there are several reasons why it may be considered beneficial. Firstly, local production reduces transportation emissions compared to overseas shipping, thereby lowering carbon footprints. The shorter distance a product has to travel, the less fuel it uses, and the fewer carbon emissions it produces. This is particularly relevant given that fossil fuels are the worst contributors to carbon emissions, and the United States has been reducing its dependence on them in recent years.

American manufacturing companies are also seeking ways to create environmentally friendly products, such as investing in eco-friendly and recycled packaging and reducing energy emissions. US manufacturers are held to higher environmental regulations than most foreign manufacturers, which typically restrict carbon emissions, ensure proper chemical management, and require appropriate waste disposal.

In addition, the FTC's Made in USA standard helps to ensure that products bearing this label are indeed made primarily in America. This standard requires that final assembly or processing occurs in the United States, and that all significant processing and ingredients or components are sourced and made in the US. This reduces the environmental impact of the supply chain by lessening reliance on foreign production.

The decision to buy American-made products can also be influenced by marketing and operational benefits, such as appealing to certain buyers who perceive these products as higher quality and produced under American labour and environmental laws.

Overall, while there are many factors that contribute to a product's environmental impact, buying American-made goods can be a step towards reducing carbon emissions and supporting environmentally conscious practices.

The US Constitution: A True Statement Exploration

You may want to see also

Frequently asked questions

According to the Federal Trade Commission (FTC), a product is considered "Made in America" or "Made in the USA" if it is "all or virtually all" made in the United States. This means that the final assembly or processing must occur in the US, and all significant processing and ingredients or components must be sourced from the US. The product should contain no or negligible foreign content.

From a marketing standpoint, the "Made in America" label is appealing to consumers as it is associated with higher quality and job security for American workers. It also conveys that the product was produced under strict US labour and environmental laws, ensuring fair wages and safe working conditions.

Buying American-made products supports local economies, sustains American jobs, ensures fair labour practices, reduces environmental impact, strengthens the domestic economy, and enhances supply chain security by reducing reliance on foreign production.

To verify if a product is genuinely "Made in America," you can refer to the manufacturer's website or look for official labelling and certification. The Federal Trade Commission (FTC) has specific criteria outlined in their "Complying with the Made in the USA Standard" document, which details the requirements for products to bear the "Made in the USA" label. Additionally, each state may have its own labelling laws and requirements.