Political campaigns are complex, costly endeavours that require significant financial resources to be successful. The sources of this funding are highly scrutinised, with strict laws and regulations in place to ensure transparency and fairness. In the United States, the Federal Election Campaign Act of 1971 (FECA) is the primary legislation governing campaign donations and spending. This act established the Federal Election Commission (FEC), which enforces campaign finance laws and sets limits on how much individuals and organisations can donate to candidates running for federal office. However, with the rise of super PACs and dark money, the landscape of campaign financing has become increasingly complex, with loopholes and legal grey areas allowing for unlimited contributions and undisclosed spending. Understanding what political campaigns are allowed to spend money on is crucial for maintaining the integrity of the democratic process and ensuring that elections are not unduly influenced by special interests.

| Characteristics | Values |

|---|---|

| Spending limits | The Federal Election Campaign Act limits the amount of money individuals and political organizations can give to a candidate running for federal office |

| Spending rules | Candidates can spend their own personal funds on their campaign without limits, but they must report the amount they spend to the Federal Election Commission (FEC) |

| Donations | Political donations are limited by the Federal Election Campaign Act, which was initially passed by Congress in 1971 |

| Independent expenditures | Independent expenditure-only political committees, or "Super PACs", can accept unlimited contributions, including from corporations and labor organizations |

| Taxpayer funding | Some presidential campaigns are funded in part by taxpayers who choose to direct $3 to the Presidential Election Campaign Fund when filing tax returns |

| Post-campaign spending | Candidates are not allowed to use any remaining funds for personal use after the campaign. Permitted uses include charitable donations, donations to other candidates, and saving for a future campaign |

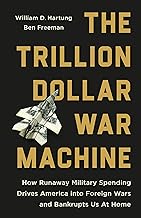

Explore related products

$20.67 $29.99

What You'll Learn

Spending limits on money

There are also limits on donations to candidates and political parties. The Federal Election Campaign Act prohibits corporations and labour unions from making direct contributions or expenditures in connection with federal elections. However, they may sponsor a "separate segregated fund" (SSF), known as a "connected PAC". Independent expenditure-only political committees, or Super PACs, may accept unlimited contributions, including from corporations and labour organisations. They can spend this money to advocate for or against any candidate or issue, but they cannot coordinate with any campaign or candidate.

There are also rules in place for how money can be spent after a campaign concludes. Leftover funds can be used for charitable donations, donated to other candidates, or saved for a future campaign. Personal use is prohibited.

Kamala Harris: Presidential Run and Her Chances

You may want to see also

Donations from corporations

Political campaigns can receive donations from corporations, but there are strict regulations in place regarding how these funds can be spent and by whom they can be received. The Federal Election Campaign Act (FECA) of 1971, enforced by the Federal Election Commission (FEC), sets limits on campaign fundraising and spending, establishes disclosure requirements, and outlines who can and cannot contribute to campaigns.

FECA prohibits corporations and labor organizations from making direct contributions to campaigns in connection with federal elections. However, corporations can contribute to specific types of political action committees (PACs). These include Super PACs, which are independent expenditure-only political committees that can accept unlimited contributions, and Hybrid PACs, which are non-contribution accounts. Corporations are also allowed to fund the expenses of setting up and administering their own PACs, known as separate segregated funds (SSFs).

While corporations cannot donate directly to federal candidates, they can provide support in other ways. For example, they can offer low-cost or pro-bono services, such as cybersecurity or legal services, to federal candidates and political committees. Additionally, domestic subsidiaries of foreign corporations are permitted to donate to state and local elections.

It is important to note that political committees are prohibited from accepting contributions that violate the established prohibitions. This includes contributions from federal government contractors, foreign nationals, and charitable organizations, which are considered a type of corporation. Furthermore, corporations are not allowed to reimburse individuals who make contributions to political committees or provide them with indirect compensation.

Crafting a Resume for Political Campaign Success

You may want to see also

Candidates' personal funds

Political campaigns can be funded in a variety of ways, including through public funding, private donations, and candidates' personal funds. Candidates are allowed to spend their own money on their campaigns without limits. This includes their portion of assets owned jointly with a spouse, such as a checking account or jointly-owned stock. However, if a candidate uses public funds, they may owe a repayment to the Treasury if they exceed expenditure limits or receive more public funds than they are entitled to.

It is important to note that there are restrictions on how candidates can spend their personal funds. For example, campaign funds cannot be used for daily household expenses, such as food or supplies, or for expenses related to deaths within the candidate's family. They also cannot be used for attire for political functions, such as a new tuxedo or dress, or for leisure activities, even if the discussion occasionally focuses on the campaign.

Furthermore, the FEC provides guidance on which expenses are considered personal use and which are considered on a case-by-case basis. These include charitable donations, gifts, candidate salary, meals, vehicles, travel, and legal expenses. Candidates must report the amount of personal funds they spend on their campaign to the FEC, and any funds received from friends or relatives are considered contributions to the campaign rather than the candidate's personal funds.

Harris: Official Nominee or Not?

You may want to see also

Explore related products

Political action committees

At the federal level, an organization becomes a PAC when it receives or spends more than $1,000 to influence a federal election and registers with the Federal Election Commission (FEC). PACs are subject to FEC rules and must file regular reports disclosing anyone who has donated at least $200.

There are different types of PACs, including traditional PACs, super PACs, and leadership PACs. Traditional PACs are connected committees that can contribute to other federal political committees, while super PACs, or independent expenditure-only political committees, cannot directly contribute to or coordinate with campaigns and candidates but can accept unlimited contributions. Leadership PACs are non-connected PACs that are established, financed, or controlled by a candidate or individual holding federal office but are not affiliated with their authorized committee. These PACs can be used to contribute funds to political allies and for expenses like travel, administrative costs, consultants, and polling.

The Federal Election Campaign Act, initially passed in 1971, and its amendments set limits on campaign fundraising and spending and established disclosure requirements for campaign contributions. However, the Supreme Court has also played a significant role in shaping campaign finance regulations, with rulings like Citizens United v. FEC (2010) that impacted the ability of corporations, unions, and other associations to spend money on political communications.

Tax Breaks for Political Candidates: Spending and Deductibles

You may want to see also

Charitable donations

Political campaigns are allowed to make charitable donations, but there are some important considerations and regulations to keep in mind. Firstly, it's essential to understand the difference between charitable donations and political contributions. Charitable donations are typically made to nonprofit organizations or charities, and they are not tax-deductible. On the other hand, political contributions are made directly to political campaigns or candidates and are subject to federal regulations and disclosure requirements.

When it comes to charitable donations, campaign committees can give gifts to charity. However, the amount donated must not be used for purposes that personally benefit the candidate. House and Senate committees report these charitable donations in the "Other Disbursements" category on their financial disclosure forms. It's important to note that if the payments to a single charity aggregate more than $200 for the election cycle, the committee must provide additional itemized information.

While charitable donations are allowed, political campaigns and candidates must be cautious not to use these donations to indirectly benefit themselves or their image. This is where the line between charitable giving and political strategy can become blurred. To maintain transparency and compliance with regulations, it is crucial for campaigns to accurately report charitable donations and ensure they do not exceed any designated contribution limits.

Additionally, it's worth noting that nonprofit organizations themselves must be careful when it comes to political involvement. While board directors, members, and staff of nonprofits are free to express their personal support for or opposition to a candidate, the organization itself must remain non-partisan to maintain its tax-exempt status. Nonprofits can contribute to the political process by providing non-partisan support to registration drives, voter education programs, and candidate debates, as long as they remain objective and do not endorse specific candidates.

Political Campaigns: How They Get Your Cell Number

You may want to see also

Frequently asked questions

Political campaigns can spend money on advertising and other efforts to influence federal elections. Campaigns are also allowed to use funds for charitable donations, donations to other candidates, and saving it for a future campaign. However, personal use of campaign funds is prohibited.

Political campaigns are funded by contributions from individuals, corporations, labor unions, and other organizations. These contributions are collected by candidates and political action committees (PACs) established in their name.

Yes, there are limits on campaign spending enforced by the Federal Election Commission (FEC) under the Federal Election Campaign Act. These limits vary depending on the office being sought and the source of the contributions.

After a political campaign concludes, any remaining funds must first be used to pay off any campaign-related debts. Candidates are prohibited from using campaign funds for personal expenses. They may choose to donate remaining funds to other candidates or charitable organizations, or save it for future campaigns.

A Super PAC, or independent expenditure-only political committee, is a group that can raise and spend unlimited amounts of money to influence elections. Unlike traditional PACs, Super PACs cannot directly contribute to or coordinate with specific campaigns or candidates. Super PACs are also subject to different disclosure requirements for their funding sources.