Political campaigns are financed through a combination of individual donations, corporations, political action committees, and sometimes the government. The legal framework surrounding campaign financing is complex, with different rules and regulations for federal, state, and local elections. This includes contribution limits, prohibitions on certain types of organizations, and reporting requirements. For example, corporations are prohibited from contributing to campaigns at the federal level, but over half of the states allow some level of corporate contributions. Additionally, the organizational structure of a campaign, whether it is a corporation or a sole proprietorship, has implications for tax filing requirements and other legal considerations.

Characteristics of a political campaign as a corporation or sole proprietorship

| Characteristics | Values |

|---|---|

| Tax requirements | Political organizations are subject to tax under IRC Section 527 and must file periodic reports. |

| Contribution sources | May accept contributions from individuals, other political committees, and PACs. Prohibited sources include corporations, labor organizations, and national banks. |

| Spending limits | Spending limits vary depending on the office sought and the source of funding (e.g., private vs. public financing). |

| Reporting requirements | Must disclose the names of contributors and may need to register with the FEC as a federal political committee. |

| Structure | A political campaign can be structured as a corporation or a sole proprietorship, with different tax and legal implications. |

Explore related products

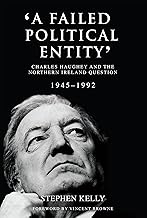

$38.52 $63

What You'll Learn

Political campaigns and tax requirements

Political campaigns have various tax requirements that they must adhere to. These requirements can vary depending on the specific circumstances of the campaign, such as the type of organization conducting the campaign, the level of office being sought (federal, state, or local), and the sources of contributions received.

In the United States, political organizations, including political parties, campaign committees for candidates, and political action committees (PACs), are generally subject to tax under Internal Revenue Code (IRC) Section 527. These organizations are typically required to obtain an employer identification number (EIN) and file periodic reports with the Internal Revenue Service (IRS), such as Form 8872, "Political Organization Report of Contributions & Expenditures."

One important aspect of political campaign tax requirements is the regulation of contributions. Campaigns are prohibited from accepting contributions from certain sources, such as corporations, labor organizations, or national banks. However, they may accept contributions from PACs established by these entities. There are also limits on the amount of contributions that can be received, which vary depending on the jurisdiction and the type of contributor. For example, in New York State, corporations, LLCs, and PLLCs are subject to a $5,000 aggregate limit on contributions to candidates and committees in a calendar year.

Additionally, candidates who use their personal funds for campaign purposes are making contributions to their campaigns, which are not subject to any limits. It is important to note that in-kind contributions, such as non-monetary goods or services, are also subject to the same limits as cash contributions, with the amount counted as the "usual and normal charge" for the good or service.

Political campaigns must also be mindful of the tax treatment of their expenses. For example, the cost of purchasing a candidate's book may be considered a campaign expense. Additionally, campaigns may receive pro bono legal services or low-cost cybersecurity services, which can impact their tax obligations.

Overall, political campaigns need to stay informed about the specific tax requirements and regulations applicable to their jurisdiction and organizational structure. Compliance with these requirements is essential to avoid legal and financial penalties.

Building a National Political Campaign: Strategies for List Growth

You may want to see also

Campaign finance and contribution limits

Campaign financing in the United States is a complex and multifaceted process, with contributions coming from individuals, corporations, political action committees, and sometimes the government. The Federal Election Commission (FEC) enforces laws regulating campaign donations, spending, and public funding enacted at the federal level by Congress.

At the federal level, corporations and labour organizations are prohibited from making direct contributions to campaigns or candidates. However, they can contribute to independent expenditure-only committees (Super PACs) and non-contribution accounts maintained by Hybrid PACs. Additionally, corporations can establish separate segregated funds (SSFs or PACs) to support political causes. These SSFs can make contributions to candidates and their authorized committees. It is important to note that a political committee that has incorporated solely for liability purposes is not considered a prohibited source of funding.

While contributions from corporations are restricted, individuals within corporations can make personal contributions. These contributions should be reported as coming from the individual rather than the corporation. Trusts can also make contributions, provided that the beneficial owner has control over the use of the trust funds.

Campaign finance laws vary at the state and local levels, with over half the states allowing some level of corporate and union contributions. For example, in New York, corporations are limited to contributing up to a total of $5,000 in a calendar year to state candidates and committees. However, this limit does not apply to funds given to housekeeping, independent expenditure, or ballot proposition committees.

The impact of campaign contributions on policy and access to politicians has been a subject of debate and research. While some studies suggest that corporations use donations to gain influence and access, others find no direct evidence of monetary benefits received by corporations from their chosen candidates' election victories.

Support Kamala Harris: Ways to Get Involved and Make a Difference

You may want to see also

Corporate donations and their influence

Corporate donations refer to financial contributions made by corporations to political parties, candidates, or political action committees (PACs). These donations can take various forms, including cash, sponsorships, and in-kind contributions, such as equipment, supplies, or professional services. The rise of impact investors and mutual funds has also led to an increase in corporate philanthropic efforts, blurring the line between philanthropy and corporate influence in politics.

Corporations make donations to further their objectives, which may be influenced by the personal convictions of their leaders or their desire to be seen as good corporate citizens. These donations have a significant impact on the landscape of campaign finance, allowing companies to exert influence and shape policies that align with their interests. This dynamic between corporate donations and political funding has transformed American elections, with major corporations strategically supporting candidates who promote their business goals.

The complex relationship between corporate donations and political influence has sparked intense political debate in the US, particularly regarding First Amendment rights. Critics argue that corporate donations corrupt democracy and call for tighter regulations. In contrast, others suggest that post-election lobbying and access to politicians shape policy decisions more than campaign contributions. The issue of transparency is crucial, as undisclosed charitable giving by corporations may be a hidden form of political influence, undetected by voters.

To address these concerns, regulations have been put in place to restrict certain types of organizations from contributing to political campaigns. For example, campaigns are prohibited from accepting treasury funds from corporations, labor organizations, or national banks. However, they may accept contributions from PACs established by these entities, as well as from separate segregated funds (SSFs) within corporations and labor organizations.

The impact of corporate donations on political campaigns is a critical issue that raises ethical and legal questions. Understanding the dynamics between corporate philanthropy and political funding is essential for maintaining the integrity of the democratic process and ensuring that elected officials prioritize the public interest over corporate interests.

Campaign Strategies: Secrets to Success

You may want to see also

Explore related products

$21.99 $27.95

Sole proprietorship and individual contributions

Sole proprietorships are treated as an extension of the owner, meaning that the owner is personally responsible for the business's gains and losses. In the context of political campaigns, this means that contributions made by a sole proprietorship are attributed to the owner.

When it comes to individual contributions to political campaigns, there are several important considerations. Firstly, individuals are allowed to contribute to political campaigns, but there are limits in place to curtail the influence of money on elections. These limits vary depending on the jurisdiction and the office being sought. For example, in New York, the contribution limits are determined based on the total number of enrolled or registered voters for a particular office.

It is worth noting that individuals can contribute to their own campaigns without any restrictions. Additionally, individuals can form political committees, which may have different contribution limits and requirements. These committees may need to be registered with the FEC as federal political committees, and they are subject to federal laws and regulations.

Furthermore, individuals can contribute to political action committees (PACs), which are organizations that aim to influence elections. There are different types of PACs, such as connected and nonconnected PACs, and they have varying levels of involvement in campaigns. It is important to note that contributions from foreign nationals in connection with any federal, state, or local election are prohibited.

In conclusion, sole proprietorships and individuals play a significant role in political campaigns through their contributions. It is important to adhere to the relevant laws and regulations to ensure compliance and transparency in the political funding process.

Kamala HQ: Legitimacy and Official Status Examined

You may want to see also

Political committees and their role

Political committees play a crucial role in the US political system, facilitating campaign finance and supporting candidates. They are subject to regulations and requirements, particularly concerning contributions and expenditures.

Types of Political Committees

There are several types of political committees, each with distinct characteristics and purposes:

- Campaign Committees: These are committees formed by candidates running for federal, state, or local office. They are responsible for managing and utilising the campaign contributions received by the candidate.

- Political Action Committees (PACs): PACs are organisations that pool campaign contributions from members and donate those funds to support or oppose candidates, ballot initiatives, or legislation. They are of three types:

- Connected PACs: Also known as corporate PACs, these are established by businesses, non-profits, labour unions, trade groups, or health organisations. They receive funds from a restricted class, such as managers and shareholders in corporations or members in non-profits.

- Non-connected PACs: These are formed by groups with an ideological mission, single-issue groups, or members of Congress and other political leaders. They solicit contributions from individuals, corporations, or other political committees.

- Super PACs: Officially called independent expenditure-only political action committees, Super PACs can raise unlimited amounts from individuals, corporations, and unions to advocate for or against political candidates. However, they cannot directly contribute to or coordinate with candidate campaigns or political parties.

Leadership PACs: These are established by members of Congress and other political leaders to support candidates for various federal and non-federal offices. They can contribute up to $5,000 per election to a federal candidate committee.

Regulations and Requirements

Political committees must adhere to various regulations and requirements regarding contributions and expenditures:

- Contribution Sources: Committees may accept contributions from trusts, individuals, and PACs established by certain entities. However, they cannot accept contributions from corporations, labour organisations, or national banks, including their treasury funds.

- Disclosure and Reporting: Political committees are required to disclose certain information, such as the names of contributors, and file periodic reports with the Federal Election Commission (FEC) and the Internal Revenue Service (IRS).

- Expenditure Rules: Expenditures by political committees must comply with relevant laws and regulations. For example, expenditures must not be used to directly influence voters' preferences for a particular candidate.

- Taxation: Political committees are generally subject to taxation under IRC Section 527 and are required to have an employer identification number (EIN).

How PACS Legally Coordinate with Candidates

You may want to see also

Frequently asked questions

A sole proprietorship is a business that is owned and run by one person, who is typically also the sole contributor to their campaign.

A corporation is a company that is recognised as a separate legal entity from its owners. Corporations are prohibited from making direct contributions to federal election campaigns but can contribute to PACs (Political Action Committees).

Corporations are prohibited from making contributions to candidates or their campaigns in federal elections. However, they can contribute to PACs, which in turn support campaigns.

No, a political campaign cannot be a corporation. Political campaigns are typically run by individuals or political parties, which are not considered separate legal entities.

A political campaign can be considered a sole proprietorship if the campaign is run and funded solely by one person. However, it is more common for campaigns to receive contributions from various individuals, corporations, and PACs.