The question of which political party best supports the middle class is a central issue in many democratic societies, as this demographic often represents the backbone of the economy and a significant voting bloc. In the United States, for example, both the Democratic and Republican parties claim to advocate for middle-class interests, though their approaches differ significantly. Democrats typically emphasize policies like progressive taxation, affordable healthcare, and investment in education to bolster economic mobility, while Republicans often focus on tax cuts, deregulation, and free-market principles to stimulate growth. In other countries, center-left and center-right parties similarly vie for middle-class support, with varying degrees of emphasis on social welfare, economic opportunity, and fiscal responsibility. Ultimately, the perception of which party truly champions the middle class often depends on individual priorities, regional contexts, and the effectiveness of policy implementation.

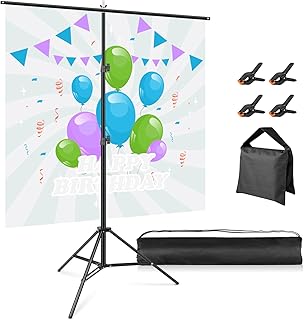

Explore related products

What You'll Learn

Democratic Policies for Middle Class

The Democratic Party has long positioned itself as a champion of the middle class, advocating for policies designed to bolster economic security, expand opportunities, and reduce inequality. Central to their approach is the belief that a thriving middle class is essential for a robust economy and a stable democracy. By focusing on wage growth, affordable healthcare, education, and tax fairness, Democrats aim to address the systemic challenges facing middle-class families. These policies are not just ideological stances but practical solutions backed by data and real-world examples.

One of the cornerstone Democratic policies for the middle class is the push for a higher minimum wage and stronger labor protections. Democrats argue that raising the federal minimum wage to $15 per hour, as proposed in the Raise the Wage Act, would directly benefit millions of workers and their families. This policy is paired with efforts to strengthen unions, which historically have been instrumental in securing better wages and working conditions. For instance, states with higher unionization rates, such as California and New York, often see narrower income gaps and higher median wages. By empowering workers, Democrats aim to reverse the decades-long stagnation in middle-class incomes and ensure that economic growth is broadly shared.

Another critical area of focus is healthcare affordability, a persistent financial burden for middle-class families. The Affordable Care Act (ACA), championed by Democrats, expanded access to health insurance and introduced protections like prohibiting insurers from denying coverage due to pre-existing conditions. Building on this, Democrats have proposed initiatives like lowering prescription drug prices and expanding Medicare coverage. For example, the Inflation Reduction Act of 2022 capped insulin costs at $35 per month for Medicare beneficiaries, a direct relief measure for middle-class households grappling with rising healthcare expenses. These policies not only reduce financial strain but also improve overall economic stability by preventing medical debt.

Education is another pillar of Democratic policies aimed at the middle class. Democrats advocate for investments in public education, from universal pre-K to tuition-free community college. The idea is to reduce the cost of education while equipping individuals with the skills needed for higher-paying jobs. For instance, the American Families Plan proposed significant funding for workforce training programs, targeting industries like clean energy and technology. By making education more accessible and affordable, Democrats aim to create pathways to upward mobility, ensuring that middle-class families can secure better opportunities for future generations.

Lastly, tax reform is a key component of Democratic efforts to support the middle class. Democrats argue for a fairer tax system where corporations and the wealthiest Americans pay their share, allowing for investments in middle-class priorities without increasing their tax burden. The 2017 Tax Cuts and Jobs Act, which Democrats criticized for disproportionately benefiting the wealthy, has been a focal point of their advocacy for reform. Proposals like increasing the corporate tax rate and closing loopholes aim to generate revenue for initiatives like infrastructure, childcare subsidies, and the expansion of the Child Tax Credit—a policy that lifted millions of children out of poverty during its temporary expansion in 2021.

In summary, Democratic policies for the middle class are multifaceted, addressing income, healthcare, education, and taxation in a holistic manner. By focusing on tangible solutions backed by evidence, Democrats aim to rebuild the economic foundation for middle-class families. While these policies are not without debate, their core objective remains clear: to create an economy that works for everyone, not just those at the top.

John Adams' Dislike for Political Parties: A Historical Perspective

You may want to see also

Republican Tax Plans Impact

Republican tax plans often emphasize reducing tax rates across the board, a strategy they argue will stimulate economic growth and benefit all income brackets, including the middle class. The Tax Cuts and Jobs Act of 2017, for instance, lowered individual income tax rates and nearly doubled the standard deduction, providing immediate tax relief for many middle-class families. A married couple filing jointly with an income of $80,000 saw an average tax cut of $2,248 in the first year, according to the Tax Policy Center. This reduction in tax liability was intended to increase disposable income, allowing families to save more or spend on essentials, thereby boosting the economy.

However, the long-term impact of these tax cuts on the middle class is less clear. While lower tax rates initially put more money in pockets, the expiration of individual tax provisions in 2025 means many middle-class households could face higher taxes unless Congress acts. Additionally, the corporate tax rate was permanently slashed from 35% to 21%, a move Republicans claimed would lead to higher wages and job creation. Yet, studies show that the bulk of corporate tax savings went to shareholders and executives rather than rank-and-file workers, leaving middle-class wage growth modest at best.

Another critical aspect of Republican tax plans is their approach to deductions and credits. The 2017 law capped the state and local tax (SALT) deduction at $10,000, disproportionately affecting middle-class families in high-tax states like California and New York. For example, a family earning $100,000 in California, where state and local taxes are high, might have previously deducted $15,000, but now faces a $5,000 reduction in deductions, effectively increasing their taxable income. This change has led to higher federal tax bills for some middle-class households, offsetting the benefits of lower tax rates.

Proponents argue that Republican tax plans create a more competitive business environment, which indirectly supports the middle class through job creation and economic expansion. However, critics point out that the plans often exacerbate income inequality by favoring the wealthy and corporations. For instance, the elimination of the corporate Alternative Minimum Tax and the reduction in the estate tax threshold primarily benefit high-income earners and heirs of large estates. Middle-class families, while receiving temporary tax cuts, may bear the brunt of increased deficits, which could lead to cuts in social programs they rely on, such as education and healthcare.

To maximize the benefits of Republican tax plans, middle-class families should take proactive steps. First, review your withholding to ensure you’re not overpaying taxes, especially if you’ve seen a reduction in your tax liability. Second, take advantage of expanded credits like the Child Tax Credit (increased to $2,000 per child under the 2017 law), which can significantly reduce your tax bill. Finally, consider consulting a tax professional to navigate changes in deductions and plan for potential tax increases after 2025. While Republican tax plans offer short-term relief, their long-term sustainability and fairness for the middle class remain subjects of intense debate.

Understanding Veniswallia's Political Landscape: Key Principles and Practices

You may want to see also

Progressive Economic Reforms

To implement these reforms effectively, policymakers must prioritize targeted investments in human capital. Expanding the Earned Income Tax Credit (EITC) to include workers without children, for example, could lift millions out of poverty while incentivizing labor force participation. Pairing this with a federal jobs guarantee program, offering positions at a living wage of $15-$20 per hour, would create a dual pathway to economic stability. Critics argue such programs are fiscally unsustainable, but evidence from European models suggests they stimulate demand and reduce long-term welfare costs, yielding a net positive economic impact.

A critical yet overlooked aspect of progressive reforms is the democratization of workplace power. Policies like the PRO Act, which strengthens collective bargaining rights, could increase median wages by 5-10% in unionized sectors. Simultaneously, capping CEO-to-worker pay ratios at 50:1, as proposed in some legislative drafts, would realign corporate incentives toward shared prosperity. These measures address the root cause of middle-class stagnation: the erosion of worker leverage in an increasingly monopolized economy.

Finally, progressive reforms must confront the housing affordability crisis, which consumes 30-50% of middle-class incomes in urban areas. A federal investment of $500 billion in social housing, coupled with rent control policies tied to local median incomes, could stabilize costs while preserving market incentives. This approach, modeled after Vienna’s successful system, demonstrates that public intervention need not stifle innovation but can instead create equitable access to essential goods. Without such bold action, the middle class will continue to be priced out of economic security.

Who's in Charge? Current Political Party Controlling the White House

You may want to see also

Explore related products

$18.19 $39.95

$16.8 $19.95

Conservative Middle-Class Focus

Conservatives often frame their policies as a lifeline for the middle class, emphasizing economic stability and individual prosperity. At the heart of this focus is a commitment to lower taxes, particularly for middle-income earners, which they argue leaves more money in the pockets of families to spend, save, or invest. For instance, the Tax Cuts and Jobs Act of 2017 in the U.S. doubled the standard deduction and reduced tax rates across brackets, benefiting many middle-class households. However, critics argue that such cuts often disproportionately favor the wealthy, raising questions about long-term equity and sustainability.

Another cornerstone of conservative middle-class support is deregulation, which they claim reduces costs for businesses and consumers alike. By easing regulatory burdens on industries like energy and healthcare, conservatives aim to lower prices for essential goods and services. For example, rolling back environmental regulations might reduce energy costs, but it could also lead to higher healthcare expenses due to increased pollution. This trade-off highlights the complexity of deregulation as a strategy for middle-class relief, requiring careful consideration of both immediate benefits and long-term consequences.

Education reform is also a key area where conservatives seek to empower the middle class. School choice initiatives, such as charter schools and voucher programs, are touted as ways to provide families with more options and improve educational outcomes. Proponents argue that competition drives quality, but opponents worry about the diversion of resources from public schools. For middle-class families, these reforms can offer opportunities for better education, but they also risk exacerbating inequalities if not implemented thoughtfully.

Finally, conservatives emphasize homeownership as a pathway to middle-class stability, advocating for policies that make it easier to buy and keep a home. This includes lowering interest rates, reducing property taxes, and streamlining the mortgage process. For instance, first-time homebuyer programs often target middle-income families, offering down payment assistance or tax credits. Yet, rising housing costs in many areas challenge the effectiveness of these measures, underscoring the need for comprehensive solutions that address both supply and demand.

In practice, the conservative approach to supporting the middle class revolves around creating an environment of economic freedom and opportunity. While their policies aim to reduce financial burdens and expand choices, their success depends on balancing short-term gains with long-term sustainability. Middle-class families considering these policies should weigh the immediate benefits against potential risks, such as reduced public services or environmental impacts. Ultimately, the conservative focus on the middle class offers a distinct vision, but its effectiveness hinges on careful implementation and ongoing evaluation.

Understanding the Role and Impact of Political Parties in the Philippines

You may want to see also

Third-Party Middle-Class Advocacy

In the United States, third-party candidates often struggle to gain traction due to the dominance of the two-party system. However, their advocacy for the middle class can offer unique perspectives and policy proposals that challenge the status quo. For instance, the Libertarian Party emphasizes reducing government intervention and lowering taxes, which they argue would benefit middle-class families by increasing disposable income. Conversely, the Green Party focuses on environmental sustainability and economic equality, proposing policies like a Green New Deal to create middle-class jobs in renewable energy sectors. These third-party platforms highlight alternative approaches to addressing middle-class concerns, often sidelined in mainstream political discourse.

To effectively advocate for the middle class, third parties must navigate significant structural barriers. Ballot access laws, debate inclusion criteria, and media coverage disproportionately favor Democrats and Republicans, limiting third-party visibility. For example, in 2020, Libertarian candidate Jo Jorgensen and Green Party candidate Howie Hawkins appeared on the ballot in 45 and 29 states, respectively, compared to the universal access of major party candidates. Despite these challenges, third parties can leverage grassroots campaigns and social media to amplify their message. A practical tip for third-party supporters is to focus on local and state-level races, where the impact of their advocacy can be more immediate and measurable, gradually building momentum for broader change.

A comparative analysis reveals that third-party middle-class advocacy often intersects with broader critiques of the two-party system. For instance, the Reform Party, founded by Ross Perot in 1995, gained traction by focusing on fiscal responsibility and reducing the national debt, issues that resonated with middle-class voters concerned about economic stability. Similarly, the Working Families Party, while not a traditional third party, has pushed for policies like paid family leave and a $15 minimum wage, directly benefiting middle-class workers. These examples demonstrate how third parties can act as catalysts for policy innovation, forcing major parties to address issues they might otherwise ignore.

Persuasively, third-party advocacy for the middle class can serve as a corrective to the polarization of American politics. By offering centrist or alternative solutions, these parties can appeal to voters disillusioned with the extremes of both major parties. For example, the Forward Party, launched in 2022, aims to bridge partisan divides by focusing on pragmatic solutions to issues like healthcare affordability and education reform. To engage effectively, middle-class voters should research third-party platforms and consider supporting candidates whose policies align with their needs, even if they have a lower chance of winning. This strategic voting can signal to major parties the importance of addressing middle-class concerns.

Finally, a descriptive examination of third-party middle-class advocacy reveals its potential to foster a more inclusive political landscape. Imagine a scenario where third parties consistently secure 5-10% of the vote, compelling major parties to incorporate their ideas into their platforms. Policies like universal basic income, proposed by the Humanist Party, or single-payer healthcare, championed by the Green Party, could gain mainstream traction. While achieving this vision requires overcoming significant hurdles, the persistence of third-party advocacy ensures that the middle class remains a focal point in political conversations, offering hope for a more representative democracy.

Black Protestants' Political Party Affiliations: Trends and Insights

You may want to see also

Frequently asked questions

The Democratic Party is often associated with policies aimed at supporting the middle class, such as progressive taxation, healthcare reform, and investments in education and infrastructure.

The Republican Party argues that its policies, such as tax cuts and deregulation, benefit the middle class by stimulating economic growth and job creation, though critics claim these policies disproportionately favor the wealthy.

Yes, third parties like the Libertarian Party and the Green Party often propose policies targeting the middle class, such as reducing government spending, promoting economic freedom, or addressing income inequality through progressive reforms.