The US Constitution prohibits setting tax payment requirements for voting. This is due to the 24th Amendment, which protects the right to vote by ensuring that payment of taxes isn't a prerequisite for voting.

| Characteristics | Values |

|---|---|

| Setting tax payment requirements | Prohibited for voting |

Explore related products

$87.67 $94.5

What You'll Learn

Setting tax payments for voting

The US Constitution prohibits setting tax payment requirements for voting. This type of tax is known as a poll tax, which is a fixed amount levied on every liable individual, regardless of their income. Poll taxes have been used historically to disenfranchise certain voters, particularly after the Reconstruction era in the US South, where they became a tool of disenfranchisement during Jim Crow.

In the past, several US states required proof of payment of a poll tax before an individual could register to vote. This included states such as Florida, Alabama, Tennessee, Arkansas, Louisiana, Mississippi, Georgia, North and South Carolina, Virginia, and Texas. The poll tax was often a significant sum, acting as a barrier to the working classes and the poor. For example, the Texas poll tax was between $1.50 and $1.75, which is equivalent to $64 in 2024. In Georgia, a cumulative poll tax was introduced in 1877, requiring men aged 21 to 60 to pay a sum of money for every year since they turned 21 or since the law was enacted.

The use of poll taxes as a prerequisite for voting was challenged in court. In 1937, the US Supreme Court upheld the constitutionality of poll taxes in the case of Breedlove v. Suttles, which involved a $1 poll tax in Georgia (equivalent to $22 in 2024). However, in 1964, the Twenty-fourth Amendment was ratified, prohibiting both Congress and the states from conditioning the right to vote in federal elections on the payment of a poll tax or any other type of tax. This was followed by the Voting Rights Act of 1965, which helped outlaw the practice nationwide and made it enforceable by law.

The Supreme Court further clarified its position in 1966, reversing its earlier decision in the case of Harper v. Virginia State Board of Elections. The Court held that imposing poll taxes in state elections violated the Equal Protection Clause of the Fourteenth Amendment to the US Constitution. This marked a significant shift in the legal landscape, ensuring that setting tax payments as a requirement for voting was prohibited and guaranteeing equal access to the ballot for all eligible citizens regardless of their economic status.

Democratic Ideals: The Constitution's Core Principles

You may want to see also

Setting residence requirements for voting

In the United States, voting rights and residence requirements vary by state. Generally, to be eligible to vote within a particular voting jurisdiction or area, an individual must be a resident of that jurisdiction/area. Residency is typically defined as presence within the jurisdiction and the intention to be a resident of the jurisdiction (i.e. the intent to stay).

The definition of residency can vary by state, and federal law mandates that no state can impose a residency requirement longer than 30 days before election day. This means that if a citizen has begun residence in a state or political subdivision within 30 days of an election and does not satisfy the registration requirements, they can still vote for President and Vice President. This can be done in person in the state or political subdivision in which they previously resided, or by absentee ballot.

For U.S. citizens born overseas who have never established residence in the United States, voting rights vary by state. In some states, citizens aged 18 or older who were born abroad but have never resided in the U.S. are eligible to vote absentee. In other cases, if neither of their parents is from one of these states, they may not have voting rights. However, additional states are working to pass legislation to allow citizens born overseas to vote in the state where their parents are eligible.

For service members, the voting residence is typically the same address listed on their Leave and Earnings Statement, which defines the state for withholding state taxes. This may be different from the home of record, which is the place they lived when they entered the military. If a service member changes their state of legal residence, they must update their voting residence.

Understanding Semi-Presidential Republics: Unitary Constitutional Systems

You may want to see also

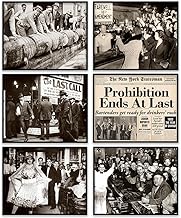

Poll taxes

The use of poll taxes as a condition of voting was not authorized until 1908, and it was upheld as constitutional by the United States Supreme Court in the 1937 case of Breedlove v. Suttles. However, there was a growing wave of criticism towards poll taxes during the 1930s and 1940s, with President Harry S. Truman establishing the President's Committee on Civil Rights to investigate the issue. Despite this, opposition to federal poll tax regulation persisted, and it was claimed that any changes would need to be made through a constitutional amendment.

The Twenty-fourth Amendment to the United States Constitution, proposed by Congress in 1962 and ratified in 1964, prohibited both Congress and the states from requiring the payment of a poll tax or any other tax as a condition of voting in federal elections. This amendment was a significant step in the pursuit of civil rights, and it was followed by the Voting Rights Act of 1965, which helped to outlaw the practice of poll taxes nationwide and made voting a constitutional right for all American men and women.

The Supreme Court further clarified the issue in the 1966 case of Harper v. Virginia State Board of Elections, ruling that poll taxes in all elections, including federal, state, and local elections, were unconstitutional as they violated the Equal Protection Clause of the Fourteenth Amendment. This ruling ensured that poll taxes could no longer be used as a barrier to voting and affirmed the right of all citizens to participate in the democratic process.

Foundational Principles of the US Constitution

You may want to see also

Explore related products

Universal suffrage

Historically, governments restricted voting rights to property owners and wealthy individuals. The First French Republic briefly adopted universal male suffrage in 1792, abolishing property requirements for voting. In 1828, the United States saw its first presidential election in which non-property-holding white males could vote in most states, though tax-paying requirements remained in some states until the 20th century. Alabama's constitution of 1819 provided universal white suffrage. The Fourteenth Amendment, ratified in 1868, granted citizenship and representation in the House of Representatives to all persons, including slaves, and protected the voting rights of males over 21. The Fifteenth Amendment, ratified after the Civil War, prohibited denying citizens the right to vote based on "race, color, or previous condition of servitude."

The women's suffrage movement gained momentum in the late 19th and early 20th centuries. South Australia granted women suffrage and allowed them to stand for parliament in 1894. Finland became the first territory to grant women full political rights in 1906, and the UK extended suffrage to women in 1928. The Nineteenth Amendment in the United States gave women the right to vote in 1920. The movement for universal suffrage also faced setbacks, such as the repeal of woman's suffrage in Utah by the Edmunds–Tucker Act of 1887.

While the "right to vote" is not explicitly stated in the US Constitution, several amendments, including the Fifteenth, Nineteenth, and Twenty-sixth Amendments, prohibit restricting voting rights based on race, colour, previous condition of servitude, sex, or age (18 and older). States have discretion in establishing qualifications for suffrage and candidacy and implementing election systems. Some states require voter registration and voter ID laws, while others do not. Federal law prohibits noncitizens from voting in federal elections, and some state constitutions explicitly limit voting rights to citizens.

Penicillin Allergy History: Low-Risk Factors

You may want to see also

Voter turnout

The Fifteenth Amendment, granting African American men the right to vote, was passed in 1870, but many were unable to exercise this right due to literacy tests and other barriers. The 19th Amendment, ratified in 1920, gave women the right to vote. However, it wasn't until the 24th Amendment in 1964 that poll taxes were abolished, removing a significant financial barrier that had been used to suppress votes, particularly among people of colour and low-income white people.

Despite these amendments, voter turnout remains lower among certain groups. For instance, in the 2012 presidential election, only 56.8% of people with disabilities reported voting, compared to 62.5% of eligible citizens without disabilities. This disparity could be due to accessibility issues, as people with disabilities may have trouble physically accessing polling places. To address this, many states offer alternatives like mail-in ballots and early voting, which have become increasingly popular. In 2020, 69% of ballots were cast before election day.

Texas Constitutions: The Core Theme Explained

You may want to see also

Frequently asked questions

The Constitution of the United States prohibits setting tax payment requirements for voting.

This prohibition is due to the 24th Amendment, which protects the right to vote.

The Constitution also prohibits setting residence requirements for voting.

The Constitution is designed to separate powers and ensure efficiency and cooperation between different branches of the government.