Proposition 13, officially named the People's Initiative to Limit Property Taxation, and known popularly as the Jarvis-Gann Amendment, was a California ballot initiative in 1978. It was an amendment to the California Constitution that limited property taxes to 1% of the assessed value, with a 2% maximum annual increase. Proposition 13 was passed by voters in June 1978, and it drastically reduced property taxes, shifting support for schools from local property taxes to state general funds. This proposition caused a significant change in state politics, marking the beginning of a period referred to as the tax revolt.

| Characteristics | Values |

|---|---|

| Official Name | Assembly Constitutional Amendment 1 |

| Commonly Known As | Proposition 13 |

| Date of Enactment | June 6, 1978 |

| Type | Constitutional Amendment |

| Purpose | Property Tax Relief and Restriction |

| Main Provisions | - Rollback of property assessments to 1975-1976 values - Limitation on property tax rates to 1% of assessed value - Restriction on annual increases in assessed value to not more than 2% - Requirement of a two-thirds supermajority vote for future state taxes |

| Impact | - Significant reduction in property tax revenue for local governments and schools - Shift in tax burden towards newer homeowners - Increased reliance on other sources of revenue, such as sales and income taxes |

| Amendments | Proposition 13 has been amended multiple times, including: - Proposition 8 (1978): Temporary reduction in assessed value during periods of declining property values - Proposition 117 (1990): Exclusion of transfers between parents and children from property reassessment - Proposition 218 (1996): Limitations on local governments' ability to impose fees and charges |

| Status | In effect, with ongoing debates and discussions regarding potential reforms |

Explore related products

What You'll Learn

- California Proposition 13, a 1978 amendment, limits property taxes to 1% of assessed value

- Additional property taxes can be approved for schools or local projects, increasing the rate

- The assessed value can increase by 2% annually or the state's CPI, whichever is less

- Properties are reassessed at 1% of the sale price upon ownership transfer

- Proposition 13 was a response to the Serrano vs Priest case, which deemed school financing by property taxes as unconstitutional

California Proposition 13, a 1978 amendment, limits property taxes to 1% of assessed value

California Proposition 13, officially named the People's Initiative to Limit Property Taxation, and popularly known as the Jarvis-Gann Amendment, was passed by voters in June 1978. It is an amendment to the California Constitution that limits the annual real estate tax on a parcel of property to 1% of its assessed value. This "assessed value" may be increased by a maximum of 2% per year, unless the property has a change of ownership or undergoes new construction, in which case it may be reassessed to the current market value. Proposition 13 also established the concept of a base year value for property tax assessments, which is the value from which future assessments are calculated.

The passage of Proposition 13 had a significant impact on school funding in California. Prior to 1978, property taxes provided about two-thirds of education revenues. However, due to the drastic reduction in property taxes, the state government had to step in and provide funding to bail out school districts. This shift in funding sources led to a change in control over the allocation of funds, with the governor and legislature taking over the distribution of local property taxes to schools, cities, counties, and special districts.

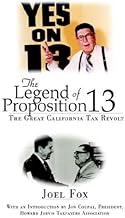

Proposition 13 was the result of a backlash against property taxes, with advocates such as Howard Jarvis and Paul Gann gaining prominence. The anger towards the tax system was fuelled by the perception of favouritism towards the wealthy and well-connected, as well as the deterioration of public schools despite high property taxes. The impact of Proposition 13 on school funding led to further referendums, such as Proposition 98, which mandated that a certain percentage of the state's budget be allocated to public education.

Proposition 13 has had a lasting impact on California's political landscape, sparking what has been referred to as the "tax revolt". It has also been the subject of subsequent amendments and initiatives, such as Proposition 218, sponsored by the Howard Jarvis Taxpayers Association, which aimed to further limit the ability of local governments to levy benefit assessments on real property and property-related fees. Despite efforts to modify or circumvent its effects, Proposition 13 remains a highly popular measure among California voters.

Federalism: Constitution, Rights, and Amendments Explained

You may want to see also

Additional property taxes can be approved for schools or local projects, increasing the rate

California's Proposition 13, passed in 1978, limits property taxes to 1% of the assessed value of the property. However, it also allows for additional property taxes to be approved for schools or local projects, which can result in a tax rate higher than 1%. These additional taxes are determined by voters in each tax rate area and can vary across communities.

The ability to approve additional taxes for schools or local projects provides flexibility and allows for increased funding when needed. This can be particularly beneficial for schools, which often require additional resources. For example, in Pennsylvania, the Scranton School District has the option to use up to 50% of its property tax reduction allocation to reduce the rate of its earned income and net profits tax.

However, critics argue that Proposition 13 has negatively impacted school funding and contributed to the deterioration of California's public schools. Before Proposition 13, California's K-12 public schools were ranked among the best nationally. Still, after its implementation, there was a decline in student achievement, partly attributed to the change in state financing of public schools.

Additionally, Proposition 13 has been criticised for limiting the ability of local governments and school districts to control spending and raise funds for local priorities. It requires a two-thirds majority vote by both houses of the California legislature to increase any state tax and a two-thirds majority vote of the electorate for local governments to impose special taxes. This dynamic has shifted funding away from local governments and towards the state, reducing local control.

Overall, while Proposition 13 limits property taxes to 1% of assessed value, the ability to approve additional taxes for schools or local projects provides some flexibility. However, the measure has also been criticised for its impact on school funding and local control over finances.

Informal Amendments: Who Proposes Changes to the Constitution?

You may want to see also

The assessed value can increase by 2% annually or the state's CPI, whichever is less

California Proposition 13, passed in 1978, limits property taxes to no more than 1% of the assessed value. This "assessed value" may be increased by a maximum of 2% per year, unless the property has a change of ownership. This 2% increase is subject to a condition: it can only be increased by 2% or the percentage increase in the state's Consumer Price Index (CPI), whichever is less.

The Consumer Price Index (CPI) is a measure of the average change in prices over time for goods and services consumed by households. It is a key metric for understanding the rate of inflation in an economy. The CPI is calculated by taking a basket of goods and services and tracking their prices over time. The change in the price of this basket of goods and services is expressed as a percentage, which is the CPI.

The CPI is used in Proposition 13 to ensure that the assessed value of properties does not increase faster than the rate of inflation. This helps to protect homeowners from rapidly increasing property taxes due to inflation. If the CPI is less than 2% in a given year, then the assessed value of properties can only increase by the CPI rate, ensuring that property taxes do not outpace inflation.

The combination of the 1% property tax limit and the 2% cap on assessed value increases helps to limit the growth of property taxes in California. This provides stability and predictability for homeowners, who can expect their property taxes to increase gradually over time, rather than fluctuating with market values.

Progressive Era: The Amendment That Wasn't

You may want to see also

Explore related products

Properties are reassessed at 1% of the sale price upon ownership transfer

California's Proposition 13, passed in 1978, limits the annual real estate tax on a property to 1% of its assessed value. This "assessed value" can increase by a maximum of 2% per year until the property is sold, at which point the assessed value is reset to the current market value. This new market value becomes the base year value for the property, and future assessments are restricted to the 2% annual maximum increase.

Proposition 13 has had a significant impact on property taxes in California, with properties that have not been sold or had new construction since February 1975 retaining their 1975 base year value. This has resulted in a widening disparity between market values and assessed values, with properties purchased more recently having higher assessed values than similar properties purchased decades ago.

When a property is sold and changes ownership, Proposition 13 requires the county assessor to reassess the property to its current fair market value as of the date of the ownership transfer. This reassessment process ensures that the property taxes are based on the most recent market value, which can result in an increase or decrease in property taxes depending on whether the market value is higher or lower than the previously assessed value.

There are certain exemptions and exceptions to the reassessment process. For example, transfers of real property between spouses, registered domestic partners, or children are typically excluded from reassessment. Transfers to trusts, business entities, or LLCs may also be exempt under specific circumstances. However, if the original owners of an LLC transfer more than 50% of the LLC cumulatively to others, the entire property will be reassessed.

It's important to note that Proposition 13 also allows for additional property taxes to be approved by voters for schools or local projects, which can result in tax rates higher than 1% in some communities. These additional taxes vary annually and are determined by voters in each tax rate area.

Constitutional Amendment 8200: Who's in Support in Washington State?

You may want to see also

Proposition 13 was a response to the Serrano vs Priest case, which deemed school financing by property taxes as unconstitutional

California's Proposition 13, officially named the People's Initiative to Limit Property Taxation, was passed by voters in June 1978. It is an amendment to the California Constitution that limits the annual real estate tax on a parcel of property to 1% of its assessed value. This "assessed value" can only be increased by a maximum of 2% per year until the property changes ownership, at which point the assessed value can be reassessed to the current market value. Proposition 13 was a response to the Serrano vs Priest case, which consisted of three cases (Serrano I, II, and III) decided by the California Supreme Court between 1971 and 1977. The case centred around the financing of public schools in California and argued that the heavy reliance on local property taxes for school funding disadvantaged students in lower-income districts, violating the Equal Protection Clause of the Fourteenth Amendment. The California Supreme Court agreed with this assessment, finding that the system created too great a disparity in funding between districts and was therefore unconstitutional. As a result of the Serrano vs Priest case and the subsequent legislative changes, Proposition 13 was introduced and passed.

Vote Yes: Empowering Change Through Constitutional Reform

You may want to see also

Frequently asked questions

California Proposition 13, also known as the Jarvis-Gann Amendment, is an amendment to the California Constitution that limits property taxes to 1% of the assessed value.

California Proposition 13 was passed to limit property taxation and address cynicism about the tax system's favoritism towards the wealthy.

California Proposition 13 limits property taxes to 1% of the assessed value, with a maximum annual increase of 2% until the property is sold.

As property taxes were a major source of school funding, California Proposition 13 caused a shift in support for schools from local property taxes to state general funds.

California Proposition 13 has been found to increase the average tenure of homeowners and renters, particularly in coastal cities. It also affects the rental market by reducing the turnover of owner-occupied homes.