Current liabilities are short-term financial obligations that are typically due within a year or within one business cycle and are paid from the revenue generated by a company's operating activities. They are listed on the balance sheet and reflect a company's ability to meet its short-term financial obligations. Current liabilities include accounts payable, short-term debt, accrued expenses, salaries payable, taxes payable, and deferred revenue. Effective management of current liabilities ensures a company's ability to meet its short-term obligations without affecting its cash flow.

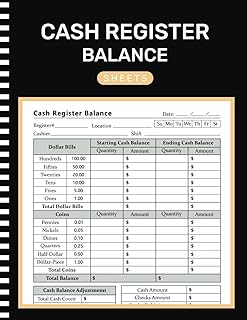

| Characteristics | Values |

|---|---|

| Definition | Short-term financial obligations payable within a year or within one business cycle of the operating company |

| Examples | Accounts payable, short-term loans, salaries payable, taxes payable, accrued expenses, deferred revenue, payroll due, payroll taxes, short-term notes payable, income taxes, interest payable, accrued interest, utilities, rental fees, other short-term debts |

| Balance Sheet Placement | Current liabilities are listed separately from long-term liabilities on the liability side of the balance sheet |

| Calculation | Current liabilities are used in the calculation of various liquidity ratios to determine a company's ability to pay its short-term obligations |

Explore related products

Accounts payable

Current liabilities are financial obligations that a company owes to third parties and are payable within 12 months. They are recorded on the liability side of the balance sheet and are paid from the revenue generated by the operating activities of a company.

AP is calculated by adding up all the money currently owed in payments to suppliers within a given time period. For example, if a company buys goods worth $5,000 from five different suppliers in a 30-day period, the total AP for that period is $25,000. This can be calculated using the accounts payable turnover ratio, which measures how many times a business pays its creditors during a specified time period.

Properly recording AP involves understanding double-entry bookkeeping and the associated credit and debit entries. It is important to differentiate between AP and accounts receivable, which represent opposite sides of a credit transaction. Accounts receivable shows all money owed to a business by customers, while accounts payable shows all debts currently owed by the business to external parties.

Managing AP well is crucial for a company's financial health and vendor relationships. It can help improve cash flow, boost short-term cash flow, and build strong relationships with vendors. On the other hand, a growing AP balance may indicate potential cash flow problems or over-reliance on supplier credit.

The Secret to Best-Selling Book Status Revealed

You may want to see also

Short-term loans

The quick ratio, which is the most common measure of short-term liquidity, helps determine a company's credit rating. It is calculated as (current assets - inventory) / current liabilities. Lenders and investors expect a company to have current assets exceeding its short-term obligations, indicating sufficient liquidity.

Effective management of short-term liabilities is crucial for maintaining smooth operations and ensuring good relationships with suppliers, creditors, and lenders. It also helps companies avoid liquidity issues and legal complications arising from unpaid bills, wages, or taxes.

US Influence on Cuba's Constitution

You may want to see also

Accrued expenses

Current liabilities are short-term financial obligations that are payable within a year or within one business cycle of the operating company. They are listed on the balance sheet and are paid from the revenue generated by the company's operating activities.

The Living Constitution: Evolving with the Times

You may want to see also

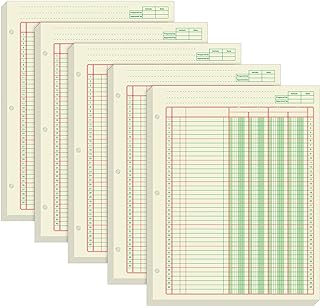

Explore related products

$17.96 $22.95

Deferred revenue

Current liabilities are short-term financial obligations that are payable within a year or within one business cycle of the operating company. They are listed on the balance sheet and are paid from the revenue generated by the company's operating activities. Current liabilities include accounts payable, accrued expenses, short-term debt, and dividends payable.

For example, consider a company that receives a $10,000 payment for services that will be delivered in the future. Initially, this payment is recorded as a debit to the cash account and a credit to the unearned revenue account. As the company delivers the services, the deferred revenue is gradually converted into earned revenue, reducing the liability on the balance sheet.

The classification of deferred revenue as a current or non-current liability depends on the prepayment terms. Typically, if the terms are for less than twelve months, it is considered a current liability. However, if the business model requires customers to make payments for several years in advance, the portion beyond the initial twelve months is classified as a non-current liability.

In summary, deferred revenue is a current liability that represents a company's obligation to deliver goods or services for which it has received advance payments. It remains on the balance sheet until the company fulfils its commitments, at which point it is recognised as income and removed from the liability section.

The Australian Constitution: Our Nation's Foundation

You may want to see also

Payroll taxes

Current liabilities are short-term financial obligations that are payable within a year or within one business cycle of the operating company. They are listed on the balance sheet and are paid from the revenue generated by the operating activities of a company.

Some payroll taxes require both the employer and employee to contribute, such as FICA taxes, which consist of Social Security and Medicare. The FICA taxes are a 50/50 split, with the current rates as of January 2025 totaling 15.3% of an employee’s gross wages. Federal unemployment is a standard rate, with employers being required to pay 6% on the first $7,000 paid to each employee in a given year as of January 2025. State unemployment varies from state to state on both the rate and the wage base and is affected by different factors unique to each state and business, such as the number of employees who have had an unemployment claim. When payroll is run, the federal and state unemployment should show up on the profit and loss as an expense while also showing up on the balance sheet as a liability until it’s paid.

Accurate tracking and timely payment of payroll liabilities are crucial to avoid penalties, legal issues, and potential damage to employee morale. Implementing reliable payroll systems and maintaining detailed records are critical best practices for managing payroll liabilities.

The Magna Carta's Influence on the US Constitution

You may want to see also

Frequently asked questions

A current liability is a short-term financial obligation that is payable within 12 months.

Examples of current liabilities include accounts payable, short-term loans, salaries payable, taxes payable, accrued expenses, and deferred revenue.

Long-term liabilities are financial obligations that a company owes to third parties and are due more than 12 months in the future.

Current liabilities are important because they are used to gauge a company's ability to meet its short-term financial obligations. Lenders and investors expect a company to have sufficient liquidity, which is calculated as current assets divided by current liabilities.

Current liabilities are reported on the liability side of the balance sheet and are typically listed at the top as the balance sheet is often arranged in ascending order of liquidity.