Adequate protection is a remedy used to compensate secured creditors for the loss in value of their collateral caused by the automatic stay, which occurs as a result of a bankruptcy filing. It is also used to protect secured creditors against loss caused by the use, sale, or lease of their collateral. This protection is necessary because lenders are precluded by the automatic stay from foreclosing or taking other action to protect the value of their property.

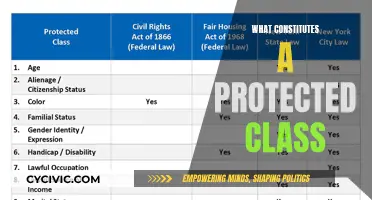

| Characteristics | Values |

|---|---|

| Adequate protection | A remedy used to compensate secured creditors for the loss in value of their collateral caused by the automatic stay, which occurs as a result of a bankruptcy filing |

| Protection for secured creditors against loss caused by the use, sale, or lease of their collateral | |

| Necessary because lenders are precluded by the automatic stay from foreclosing or taking other action to protect the value of their property | |

| Defined in Section 361 of the Bankruptcy Code | |

| A debtor must make a cash payment or payments to the extent the stay results in a decrease in the value of its collateral | |

| A debtor must provide the creditor with an additional or replacement lien, such as a replacement lien on post-petition accounts receivable | |

| A debtor must grant other relief that will result in the "realization" of the "indubitable equivalent" of the creditor's interest in its collateral | |

| Creditors that lack collateral ("unsecured creditors") are not entitled to adequate protection payments |

Explore related products

What You'll Learn

Adequate protection in the case of bankruptcy

Adequate protection is a remedy used to compensate secured creditors for the loss in value of their collateral caused by the automatic stay, which occurs as a result of a bankruptcy filing. It is also used to protect secured creditors against loss caused by the use, sale, or lease of their collateral. This protection is necessary because lenders are precluded by the automatic stay from foreclosing or taking other action to protect the value of their property.

Adequate protection is defined in Section 361 of the Bankruptcy Code. Under Section 361, a debtor must: (1) make a cash payment or payments to the extent the stay results in a decrease in the value of its collateral; or 2) provide the creditor an additional or replacement lien, such as a replacement lien on post-petition accounts receivable. In other words, adequate protection is such action as is judicially determined to protect a secured creditor's interest in property that is part of a bankrupt estate.

In the special instance where there is a reserve fund maintained under the security agreement, such as in the typical bondholder case, indubitable equivalent means that the bondholders would be entitled to be protected as to the reserve fund, in addition to the regular payments needed to service the debt. Adequate protection of an interest of an entity in property is intended to protect a creditor’s allowed secured claim. To the extent the protection proves to be inadequate after the fact, the creditor is entitled to a first priority administrative expense under section 503(b).

It is important to note that creditors that lack collateral ("unsecured creditors") are not entitled to adequate protection payments.

Constitution's Slaveholder Safeguards: Intentional or Unintentional?

You may want to see also

Adequate protection for secured creditors

Adequate protection is a remedy used to compensate secured creditors for the loss in value of their collateral caused by the automatic stay, which occurs as a result of a bankruptcy filing. It is also used to protect secured creditors against loss caused by the use, sale, or lease of their collateral. This protection is necessary because lenders are precluded by the automatic stay from foreclosing or taking other action to protect the value of their property.

Adequate protection is defined in Section 361 of the Bankruptcy Code. Under this section, a debtor must: (1) make a cash payment or payments to the extent the stay results in a decrease in the value of its collateral; or 2) provide the creditor with an additional or replacement lien, such as a replacement lien on post-petition accounts receivable.

In the context of a Chapter 11 bankruptcy case, a lender who has a lien on the debtor's assets is entitled to adequate protection. This means that the debtor must either make cash payments to cover the decrease in the value of the collateral or provide the creditor with an additional or replacement lien.

In certain cases, such as when there is a reserve fund maintained under a security agreement, adequate protection may also include protecting the creditor's interest in the reserve fund, in addition to regular debt service payments.

Overall, adequate protection for secured creditors aims to safeguard their interests and ensure they are compensated for any losses incurred during the bankruptcy process.

Biometric Data: Is It Protected by the Constitution?

You may want to see also

Adequate protection for unsecured creditors

Adequate protection is a remedy used to compensate secured creditors for the loss in value of their collateral caused by the automatic stay, which occurs as a result of a bankruptcy filing. It is also used to protect secured creditors against loss caused by the use, sale, or lease of their collateral. This protection is necessary because lenders are precluded by the automatic stay from foreclosing or taking other action to protect the value of their property.

Adequate protection is defined in Section 361 of the Bankruptcy Code. Under Section 361, a debtor must: (1) make a cash payment or payments to the extent the stay results in a decrease in the value of its collateral; or (2) provide the creditor with an additional or replacement lien, such as a replacement lien on post-petition accounts receivable.

However, creditors that lack collateral ("unsecured creditors") are not entitled to adequate protection payments. This is because adequate protection is a judicially determined action to protect a secured creditor's interest in property that is part of a bankrupt estate. The U.S. Bankruptcy Code offers a list of examples of actions that are predetermined to provide adequate protection.

In the special instance where there is a reserve fund maintained under the security agreement, such as in the typical bondholder case, indubitable equivalent means that the bondholders would be entitled to be protected as to the reserve fund, in addition to the regular payments needed to service the debt. Adequate protection of an interest of an entity in property is intended to protect a creditor’s allowed secured claim. To the extent that the protection proves to be inadequate after the fact, the creditor is entitled to a first priority administrative expense under section 503(b).

The Constitution's Anti-Discrimination Shield: Fact or Fiction?

You may want to see also

Explore related products

$44.88 $79.99

Adequate protection for bondholders

Adequate protection is a remedy used to compensate secured creditors for the loss in value of their collateral caused by the automatic stay, which occurs as a result of a bankruptcy filing. It is also used to protect secured creditors against loss caused by the use, sale, or lease of their collateral.

In the context of bondholders, adequate protection is provided for in Section 361 of the Bankruptcy Code. This section defines adequate protection as allowing a debtor to:

- Make a cash payment or payments to the extent the stay results in a decrease in the value of its collateral;

- Provide the creditor with an additional or replacement lien; or

- Grant other relief that will result in the "realization" of the "indubitable equivalent" of the creditor's interest in its collateral.

In the typical bondholder case, the indubitable equivalent means that bondholders are entitled to protection regarding the reserve fund, in addition to the regular payments needed to service the debt. This protection is intended to safeguard the creditor's allowed secured claim.

Bond covenants are another way to provide adequate protection for bondholders. Affirmative covenants, for example, require the bond issuer to perform certain actions or maintain certain standards, such as paying interest and principal on time, maintaining adequate insurance coverage, and keeping accurate financial records. These covenants benefit the bondholder by reducing default risk and increasing transparency. Financial covenants provide an early warning of the bond issuer's financial distress, triggering corrective actions if necessary. They also impose restrictions on the actions of the issuer to prevent them from impairing their ability to repay the bond or reducing its value.

Additionally, the Law provides for two new institutions – a bondholders' representative and a general meeting of bondholders – to further protect the rights of bondholders.

Fire Alarms: Essential Part of Fire Protection System?

You may want to see also

Adequate protection for lenders

Lenders are precluded by the automatic stay from foreclosing or taking other action to protect the value of their property. Adequate protection is defined in Section 361 of the Bankruptcy Code. Under Section 361, a debtor must: (1) make a cash payment or payments to the extent the stay results in a decrease in the value of its collateral; or 2) provide the creditor an additional or replacement lien, such as a replacement lien on post-petition accounts receivable.

During a Chapter 11 case, a lender who has a lien on the debtor’s assets is entitled to “adequate protection”. This means that the debtor must either make cash payments to cover the loss in value of the collateral or provide the creditor with an additional or replacement lien. In some cases, other relief may be granted to realise the "indubitable equivalent" of the creditor's interest, such as granting protection to a reserve fund.

The U.S. Bankruptcy Code offers a list of examples of actions that are predetermined to provide adequate protection. When a court finds that a secured creditor is not adequately protected, the creditor may obtain relief from the automatic stay from creditors' collection attempts that are effected by the debtor's filing for bankruptcy.

Polygamy's Constitutional Protection: Interpreting Relationship Rights

You may want to see also

Frequently asked questions

Adequate protection is a remedy used to compensate secured creditors for the loss in value of their collateral caused by the automatic stay, which occurs as a result of a bankruptcy filing.

Lenders who have a lien on the debtor's assets are entitled to adequate protection. However, creditors that lack collateral ("unsecured creditors") are not entitled to adequate protection payments.

Adequate protection involves the debtor either: (1) making a cash payment or payments to the extent the stay results in a decrease in the value of its collateral; or (2) providing the creditor with an additional or replacement lien, such as a replacement lien on post-petition accounts receivable.

Adequate protection is determined by a court, which will decide whether a secured creditor's interest in property that is part of a bankrupt estate is adequately protected.

![KwikSafety - SCORPION Safety Harness [w/Attached 6ft Lanyard] Safety Harness Fall Protection Kit ANSI OSHA](https://m.media-amazon.com/images/I/819ETxppzIL._AC_UL320_.jpg)