The Qualified Business Income (QBI) deduction, also known as Section 199A, is a tax deduction that allows eligible self-employed individuals and small business owners to deduct up to 20% of their QBI. QBI is the net amount of qualified items of income, gain, deduction, and loss from any qualified trade or business. This includes income from partnerships, S corporations, sole proprietorships, and certain trusts. The QBI deduction was introduced as part of the 2017 Tax Cuts and Jobs Act (TCJA) and is available to taxpayers with total taxable income below certain thresholds, which vary by year and filing status.

| Characteristics | Values |

|---|---|

| Entities eligible for the deduction | Sole proprietorships, Partnerships, S corporations, Trusts, Estates, Limited liability companies (LLCs), and some single-member LLCs |

| Type of business | Pass-through business |

| Income types included | Income, Gain, Deduction, Loss |

| Tax deduction | Up to 20% of QBI |

| Tax year | For tax years beginning after December 31, 2017 |

| Total taxable income in 2023 | Up to $182,100 for single filers or $364,200 for joint filers |

| Total taxable income in 2024 | Up to $191,950 for single filers or $383,900 for joint filers |

| Exclusions | Capital gains or losses, Income from businesses outside the US, Interest income |

Explore related products

What You'll Learn

QBI component

The QBI component of the Qualified Business Income (QBI) deduction allows eligible taxpayers to deduct 20% of their qualified business income from a domestic business. This includes income from businesses operated as a sole proprietorship, S corporation, partnership, estate, or trust.

QBI is the net amount of qualified items of income, gain, deduction, and loss from any qualified trade or business. This includes income from partnerships, S corporations, sole proprietorships, and certain trusts. It is important to note that QBI does not include investment income, such as capital gains or losses, or dividends, income from businesses outside the US, and interest income not properly allocable to a trade or business.

The QBI component is subject to limitations depending on the nature of the trade or business. For instance, the type of trade or business, the amount of W-2 wages paid by the qualified trade or business, and the unadjusted basis immediately after acquisition (UBIA) of qualified property held by the trade or business may impact the QBI deduction. Additionally, if the taxpayer is a patron of an agricultural or horticultural cooperative, their QBI deduction may be reduced.

To determine eligibility for the QBI deduction, it is important to consider the total taxable income, including business income and other sources. For tax years beginning after December 31, 2017, eligible taxpayers can deduct up to 20% of their QBI. In 2023, the total taxable income threshold for single filers is $182,100, while it is $364,200 for joint filers. These limits will increase in 2024 to $191,950 for single filers and $383,900 for joint filers.

In summary, the QBI component of the Qualified Business Income deduction allows eligible taxpayers to deduct 20% of their qualified business income, subject to certain limitations and income thresholds.

South Carolina's Constitution: Achievements and Legacy

You may want to see also

REIT/PTP component

The REIT/PTP component of the Qualified Business Income (QBI) deduction is an additional deduction that eligible taxpayers can claim. It equals 20 percent of qualified real estate investment trust (REIT) dividends and qualified publicly traded partnership (PTP) income. This component is not limited by W-2 wages or the unadjusted basis immediately after acquisition (UBIA) of qualified property.

The QBI deduction was introduced as part of the 2017 Tax Cuts and Jobs Act (TCJA). It allows eligible self-employed individuals and small business owners to deduct up to 20% of their QBI. The REIT/PTP component is an additional deduction that can be claimed on top of the QBI deduction.

To be eligible for the REIT/PTP component, an individual must have dividends from a qualified REIT or PTP income in the tax year. This includes REIT dividends earned through a regulated investment company (RIC). The REIT/PTP component is not subject to the same limitations as the QBI component, which depends on the taxpayer's taxable income, trade or business, W-2 wages, and UBIA of qualified property.

However, the amount of PTP income that qualifies for the REIT/PTP component may be limited depending on the type of the PTP's trade or business. This means that even though the REIT/PTP component is not directly limited by the nature of the trade or business, the underlying PTP income may be limited by its trade or business nature.

Overall, the REIT/PTP component provides an additional tax benefit for eligible taxpayers with qualified REIT dividends and PTP income. It is important to note that the QBI deduction, including the REIT/PTP component, is subject to various restrictions and limitations, and not all income falls under qualified business income. Therefore, taxpayers should carefully review the requirements and consult with tax professionals to determine their eligibility and calculate their specific deductions.

Effective EIAs: Sustainable, Comprehensive, and Long-term

You may want to see also

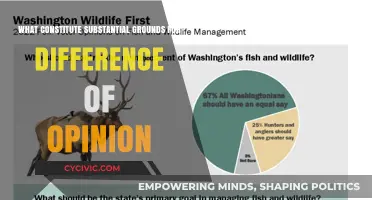

Income sources

The Qualified Business Income (QBI) deduction is a tax deduction that allows eligible self-employed individuals and small business owners to deduct up to 20% of their QBI. QBI is the net amount of qualified items of income, gain, deduction, and loss from any qualified trade or business. This includes income from partnerships, S corporations, sole proprietorships, and certain trusts.

QBI does not include investment income, such as capital gains or losses, or dividends. It also does not include income from businesses located outside of the US or interest income not properly allocable to a trade or business.

The QBI deduction is available to owners of pass-through businesses, which are businesses where the business income passes through to the owners to be taxed on their individual tax returns. Pass-through businesses include sole proprietorships, partnerships, limited liability companies (LLCs), and S corporations.

In addition to the QBI component, there is also a REIT/PTP component to the QBI deduction. This component allows for a deduction of 20% of qualified REIT dividends and qualified PTP income. This component is not limited by W-2 wages or the unadjusted basis immediately after acquisition (UBIA) of qualified property.

The Constitution Test: An 8th-Grade Graduation Requirement

You may want to see also

Explore related products

Taxable income limits

The Qualified Business Income (QBI) deduction is a tax incentive for self-employed people and small-business owners. It allows eligible taxpayers to deduct up to 20% of their QBI, which is the net amount of qualified items of income, gain, deduction, and loss from any qualified trade or business. This deduction is also available for 20% of qualified real estate investment trust (REIT) dividends and qualified publicly traded partnership (PTP) income.

The QBI deduction is only available to owners of pass-through businesses, even if they have opted for the standard deduction. A pass-through business is a sole proprietorship, partnership, LLC (limited liability company) or S corporation. The term “pass-through” comes from the way these entities are taxed. Unlike a C corporation, which pays corporate income taxes, a pass-through entity’s business income is taxed on the owner's individual tax return.

The QBI deduction is subject to limitations, depending on the taxpayer's taxable income. This may include the type of trade or business, the amount of W-2 wages paid by the qualified trade or business, and the unadjusted basis immediately after acquisition (UBIA) of qualified property held by the trade or business.

If a business is a "specified service trade or business" (SSTB), the QBI deduction may be limited or eliminated if the taxpayer's taxable income reaches a certain threshold. The IRS defines an SSTB as:

> "A trade or business involving the performance of services in the fields of health, law, accounting, actuarial science, performing arts, consulting, athletics, financial services, investing and investment management, trading or dealing in certain assets, or any trade or business where the principal asset is the reputation or skill of one or more of its employees or owners."

For 2023, the income limits for the QBI deduction are $182,100 for single filers and $364,200 for joint filers. In 2024, these limits increase to $191,950 for single filers and $383,900 for joint filers. Above these limits, the ability to claim the pass-through deduction depends on the nature of the business.

Billing Units: Understanding an 8-Hour Shift

You may want to see also

Deduction eligibility

The Qualified Business Income (QBI) deduction is a tax deduction that allows eligible self-employed and small-business owners to deduct up to 20% of their qualified business income on their taxes. It was introduced as part of the 2017 Tax Cuts and Jobs Act (TCJA). The QBI deduction is available for tax years beginning after December 31, 2017, and unless extended by Congress, will expire on December 31, 2025.

The QBI deduction is only available to owners of pass-through businesses, including sole proprietorships, partnerships, S corporations, and limited liability companies (LLCs). A pass-through business is one where the business income passes through to the owners to be taxed on their individual tax returns, rather than the business itself being taxed.

To be eligible for the QBI deduction, the total taxable income in 2023 must be under $182,100 for single filers or $364,200 for joint filers. In 2024, the limits rise to $191,950 for single filers and $383,900 for joint filers. If income is above these limits, the ability to claim the pass-through deduction depends on the nature of the business.

There are also certain limitations and restrictions on the QBI deduction. For example, it does not include investment income such as capital gains or losses, or dividends, and income from businesses located outside the US. Additionally, if the entity is a specified service trade or business (SSTB), the deduction may be limited or eliminated if the taxpayer's taxable income reaches a certain limit.

Madison's Constitution: What Were His Main Issues?

You may want to see also

Frequently asked questions

The QBI deduction is a tax deduction that allows eligible self-employed and small-business owners to deduct up to 20% of their qualified business income on their taxes.

Entities eligible for the QBI deduction include: sole proprietorships, partnerships, S corporations, limited liability companies (LLCs), and some trusts and estates.

Unless extended by Congress, the QBI deduction will expire on December 31, 2025.

The QBI component is subject to limitations depending on the taxpayer's income, which may include the type of trade or business, W-2 wages paid, and the unadjusted basis immediately after acquisition (UBIA) of qualified property held by the trade or business. The REIT/PTP component is not limited by W-2 wages or UBIA of qualified property.

The QBI deduction is calculated as 20% of your QBI, which is the net amount of qualified items of income, gain, deduction, and loss from any qualified trade or business.

![H&R Block Tax Software Deluxe + State 2024 with Refund Bonus Offer (Amazon Exclusive) Win/Mac [PC/Mac Online Code]](https://m.media-amazon.com/images/I/51+fonAXhPL._AC_UY218_.jpg)

![[OLD VERSION] TurboTax Deluxe 2024 Tax Software, Federal & State Tax Return [PC/MAC Download]](https://m.media-amazon.com/images/I/71UbHaUeeUL._AC_UY218_.jpg)

![[OLD VERSION] TurboTax Home & Business 2024 Tax Software, Federal & State Tax Return [PC/MAC Download]](https://m.media-amazon.com/images/I/71b5aAzdXOL._AC_UY218_.jpg)