Chasing payments can be a delicate task, as it requires balancing professionalism with the need to maintain positive client relationships. When done politely, it not only ensures timely payment but also reinforces trust and respect. To approach this effectively, start by verifying that the invoice was received and understood, then gently remind the client of the payment terms and due date. Use a friendly and courteous tone, avoiding any language that could be perceived as confrontational. Offering flexibility, such as suggesting alternative payment methods or discussing potential payment plans, can also help ease the process. By focusing on clear communication and empathy, you can navigate this conversation smoothly while safeguarding your business interests.

| Characteristics | Values |

|---|---|

| Professional Tone | Use formal and respectful language to maintain a positive relationship. |

| Clear Communication | Clearly state the purpose of the message and the amount due. |

| Timely Follow-Up | Send reminders at regular intervals (e.g., 7 days, 14 days, 30 days). |

| Gratitude | Express appreciation for their business and prompt attention to the matter. |

| Payment Options | Provide multiple payment methods for convenience (e.g., bank transfer, credit card). |

| Reference Details | Include invoice number, date, and any relevant transaction details. |

| Polite Urgency | Gently emphasize the importance of timely payment without being aggressive. |

| Personalization | Address the recipient by name and tailor the message to their situation. |

| No Blame or Accusation | Avoid accusatory language; assume oversight or misunderstanding. |

| Call to Action | Clearly state what you want them to do next (e.g., "Please settle by [date]"). |

| Follow-Up Persistence | Escalate politely if no response (e.g., phone call after multiple emails). |

| Legal Reference (if necessary) | Mention late payment terms or consequences only as a last resort. |

Explore related products

What You'll Learn

Start with a friendly reminder

A friendly reminder is often the most effective first step in chasing a payment, as it maintains a positive relationship while addressing the issue. Begin by acknowledging the recipient’s past reliability or your appreciation for their business. For instance, “We’ve always appreciated your prompt payments and wanted to check in about invoice #12345, which is now 10 days past due.” This approach softens the request and reminds them of their usual professionalism. Keep the tone light and non-confrontational, using phrases like “Just a quick reminder” or “We noticed this might have slipped through the cracks.”

The structure of your reminder matters. Start with a warm greeting, followed by a clear reference to the unpaid invoice, including the amount and due date. For example, “Hi [Name], hope you’re doing well. We wanted to bring your attention to invoice #5678 for $500, due on October 15th.” Avoid jargon or overly formal language, as it can feel impersonal. Instead, use a conversational tone that aligns with your existing relationship. If you’ve communicated casually in the past, maintain that style; if it’s been more formal, keep it professional but approachable.

Timing is crucial when sending a friendly reminder. Aim to send it 3–5 days after the payment deadline to give the recipient a grace period without letting the issue linger. If you’re using email, ensure the subject line is clear but gentle, such as “Friendly Reminder: Invoice #12345 Due October 15th.” For businesses with recurring payments, consider automating these reminders to save time while maintaining consistency. Tools like accounting software often allow you to schedule polite follow-ups without appearing overly aggressive.

Finally, end your reminder with a call to action that encourages resolution. Offer multiple ways to settle the payment, such as a link to an online portal or your bank details, and express willingness to assist. For example, “If you have any questions or need further assistance, please let us know. We’re here to help!” This not only makes it easier for them to act but also reinforces your commitment to a collaborative relationship. A friendly reminder, when done right, can often resolve the issue without escalating tensions.

Mastering the Art of Polishing Corn: A Step-by-Step Guide

You may want to see also

Highlight the overdue invoice details

Clear and concise communication is key when highlighting overdue invoice details. Begin by referencing the specific invoice number, date, and amount owed. This immediately grounds the conversation in facts, avoiding ambiguity. For instance, instead of a vague "We’re following up on your payment," say, "Invoice #12345, issued on March 15th for $500, is now 30 days past due." This direct approach leaves no room for misinterpretation and sets a professional tone.

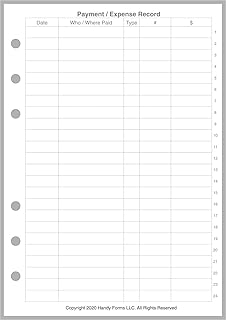

When structuring your message, use a table or bullet points to break down the invoice details. This visual clarity makes it easier for the recipient to understand the issue at a glance. Include the original due date, the current overdue period, and any late fees or interest accrued, if applicable. For example:

- Invoice #: 12345

- Date Issued: March 15th, 2023

- Amount Due: $500

- Due Date: April 15th, 2023

- Days Overdue: 30

- Late Fee (if applicable): $25

While being factual, maintain a polite and empathetic tone. Acknowledge that oversight or delays can happen and express your willingness to assist. For instance, "We understand that delays can occur and are here to help resolve this promptly." This approach balances firmness with courtesy, encouraging cooperation rather than defensiveness.

Finally, provide a clear call to action. Specify how and by when you expect payment or a response. For example, "Please remit payment by [specific date] or contact us to discuss alternative arrangements." Including payment options, such as a direct link to an online portal or bank details, can further streamline the process. This combination of clarity, empathy, and actionable steps maximizes the likelihood of a swift resolution.

Your Political Compass: How Ideology Shapes Your Final Moments

You may want to see also

Offer flexible payment options

Offering flexible payment options can transform a tense payment chase into a collaborative conversation. When clients feel empowered to choose how they settle their dues, they’re more likely to engage positively. For instance, instead of a rigid "pay in full now" demand, propose options like splitting the amount into two installments or extending the deadline by 10 days. This approach shifts the dynamic from confrontation to accommodation, making clients feel understood rather than pressured.

Analyzing client behavior reveals that flexibility often accelerates payment. Small businesses that introduced tiered payment plans—such as 50% upfront and 50% upon completion—reported a 30% reduction in late payments. The key lies in aligning options with the client’s cash flow. For example, freelancers working with startups might offer net-30 terms, while those serving established corporations could suggest automated monthly deductions. Tailoring flexibility to the client’s financial rhythm builds trust and ensures timely resolution.

However, flexibility isn’t without risks. Without clear boundaries, it can lead to further delays. To mitigate this, set explicit terms for each option. For instance, if offering a payment plan, specify late fees (e.g., 5% after the agreed date) or require a signed agreement. Tools like payment links with built-in schedules or platforms like PayPal Invoicing can automate reminders and enforce deadlines, ensuring flexibility doesn’t become leniency.

Persuasively, framing flexible options as a mutual benefit can seal the deal. Phrase it as, "To make this easier for you, I’ve included two payment options—let me know which works best." This language positions you as a problem-solver, not a collector. Additionally, highlight the value they’ve already received from your service or product, reinforcing the fairness of the request. For instance, "Given the project’s success, I’d love to finalize the payment so we can both close this chapter positively."

In practice, start by assessing the client’s history and current situation. For repeat clients with occasional delays, offer a grace period or discounted early payment. For new clients, propose a deposit-based structure to secure commitment. Always follow up with a polite reminder 48 hours before the deadline, reiterating the chosen option and providing a direct payment link. This proactive yet considerate approach ensures flexibility serves both parties, turning payment chases into opportunities to strengthen relationships.

Coronavirus: Political Scam or Global Health Crisis? Uncovering the Truth

You may want to see also

Explore related products

Express understanding and urgency

Chasing payments can feel like walking a tightrope—too aggressive, and you risk damaging relationships; too passive, and you may never see the funds. Expressing understanding and urgency strikes a balance, acknowledging the client’s situation while firmly communicating the importance of timely payment. Start by recognizing their potential challenges—whether it’s cash flow issues, administrative delays, or oversight. For example, instead of opening with a demand, say, *"I understand that managing finances can be complex, especially during busy periods."* This empathetic tone disarms defensiveness and opens the door for collaboration.

The key to conveying urgency lies in specificity. Vague reminders like *"Please pay soon"* lack impact. Instead, provide clear deadlines and consequences in a professional, non-threatening way. For instance, *"To avoid any disruption in service, we’d appreciate receiving payment by [specific date]. After [date], a late fee of [amount] will apply as per our agreement."* This approach respects their position while emphasizing the time-sensitive nature of the request. Pairing understanding with actionable details transforms the message from a nagging reminder to a constructive prompt.

A comparative analysis of successful payment reminders reveals that those combining empathy with urgency outperform blunt demands. For example, a study by the Institute of Finance & Management found that invoices with personalized, understanding language saw a 25% higher response rate within 7 days compared to generic follow-ups. Similarly, including phrases like *"We value our partnership and want to ensure everything stays on track"* fosters goodwill while reinforcing the need for prompt action. This dual approach not only accelerates payment but also strengthens the client relationship.

Practical tips can further enhance your communication. Use a three-step structure: acknowledgment, request, and consequence. For instance, *"I know [specific challenge they’ve mentioned], and I appreciate your attention to this matter. Could you confirm payment by [date]? After [date], we’ll need to place the account on hold until funds are received."* Keep the tone conversational yet firm, avoiding jargon or passive-aggressive language. Additionally, leverage tools like payment portals or automated reminders to streamline the process, reducing the emotional weight of manual follow-ups.

In conclusion, expressing understanding and urgency is an art that blends empathy with clarity. By acknowledging the client’s context, setting precise deadlines, and outlining consequences, you create a compelling yet respectful call to action. This approach not only expedites payment but also preserves trust, turning a potentially awkward interaction into an opportunity to reinforce your professionalism and reliability.

Office Politics: An Inevitable Reality in Every Workplace Environment?

You may want to see also

Suggest a follow-up deadline politely

Setting a follow-up deadline is an art that balances urgency with courtesy. Begin by acknowledging the recipient’s potential oversight or busy schedule—a simple "I understand how things can slip through the cracks" softens the tone. Then, propose a specific date for resolution, such as "Could we aim to finalize this by the end of next week?" This approach avoids ambiguity while maintaining professionalism. For instance, instead of saying, "I need this ASAP," frame it as, "To keep our records updated, would Friday work for you?" This method respects their time while clearly communicating expectations.

The psychology behind deadlines is worth noting: a precise date is more actionable than a vague timeframe. Research shows that people are 34% more likely to respond when given a concrete deadline. However, avoid overly aggressive language like "final notice" unless it’s a last resort. Instead, use phrases like "to ensure we stay on track" or "for my records." Pairing the deadline with a benefit to them, such as "This will help us avoid any late fees on our end," can also encourage cooperation.

When suggesting a deadline, consider the context. For overdue invoices, a 7-day follow-up is standard, but for larger sums or long-standing relationships, 10–14 days may be more appropriate. Always reference the original agreement or communication to refresh their memory, e.g., "As per our discussion on the 15th, I’m following up on the payment due." This reinforces accountability without sounding accusatory. If you’re using email, bold the deadline date to make it stand out, but keep the tone warm and collaborative.

A cautionary note: avoid passive-aggressive tactics like excessive reminders or guilt-tripping. For example, "Just checking in again" can come across as nagging. Instead, frame the follow-up as a mutual goal. Say, "Let’s work together to wrap this up by [date]." If the deadline passes without response, escalate gracefully by offering alternative payment methods or suggesting a quick call to discuss. The key is to remain firm but flexible, showing you value the relationship as much as the payment.

In practice, combine clarity with empathy. For instance, "I noticed the payment hasn’t been processed yet—would [specific date] work for you to complete it? I’d hate for this to impact your account status." This phrasing addresses the issue directly while offering a solution. Tools like calendar invites or payment reminders can also reinforce the deadline without requiring additional follow-ups. By treating the deadline as a collaborative milestone, you increase the likelihood of timely resolution while preserving goodwill.

Cindy McCain's Political Journey: From Philanthropy to Public Service

You may want to see also

Frequently asked questions

Begin with a friendly and professional tone, referencing the invoice and due date. Express understanding and inquire if there’s an issue or oversight. For example, "Hi [Client Name], I hope this message finds you well. I noticed Invoice #[Number] is past due. Could you confirm if everything is in order or if there’s anything I can assist with?"

Use a polite and proactive approach by sending reminders before the due date and at regular intervals afterward. Keep the language courteous and concise, such as, "Just a friendly reminder that Invoice #[Number] is due on [Date]. Please let me know if you need further assistance."

Start with a reminder 3–5 days before the due date, then follow up 1–2 days after it’s overdue. If still unpaid, send another reminder after 7–10 days, and consider a phone call or more direct communication after 14–21 days. Always maintain professionalism and offer flexibility if needed.