Chasing money, whether it’s overdue payments, investments, or business deals, can be a delicate task that requires tact and professionalism. Striking the right balance between assertiveness and politeness is key to maintaining relationships while ensuring financial obligations are met. By using clear, respectful communication, setting realistic expectations, and offering solutions rather than demands, you can navigate these conversations effectively. Understanding the other party’s perspective and approaching the situation with empathy can also foster cooperation and increase the likelihood of a positive outcome. This approach not only preserves mutual respect but also builds trust, making future financial interactions smoother and more productive.

| Characteristics | Values |

|---|---|

| Professional Tone | Use formal and respectful language to maintain a courteous demeanor. |

| Clear Communication | Specify the amount owed, due date, and any relevant details. |

| Timely Follow-Up | Send reminders promptly after the payment deadline has passed. |

| Gratitude | Express appreciation for the business relationship or past payments. |

| Payment Options | Provide multiple payment methods for convenience (e.g., bank transfer, credit card). |

| Polite Urgency | Use phrases like "kindly" or "at your earliest convenience" to convey urgency politely. |

| Avoid Accusatory Language | Refrain from blaming or using aggressive terms like "overdue" or "late." |

| Personalized Approach | Address the recipient by name and tailor the message to their situation. |

| Documentation | Attach invoices or payment records to remind the recipient of the obligation. |

| Follow-Up Frequency | Limit follow-ups to avoid being perceived as pushy (e.g., once a week). |

| Offer Assistance | Provide contact information and offer help if there are payment issues. |

| Legal Mention (if necessary) | Politely mention potential consequences if payment remains unresolved (as a last resort). |

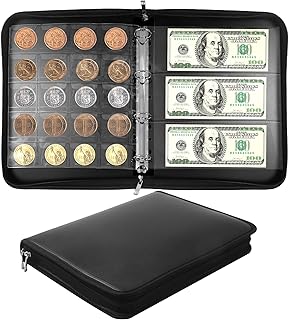

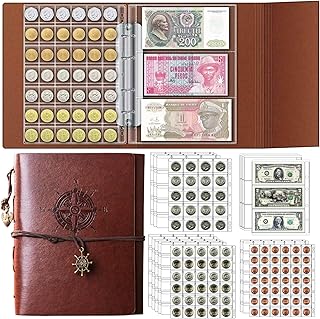

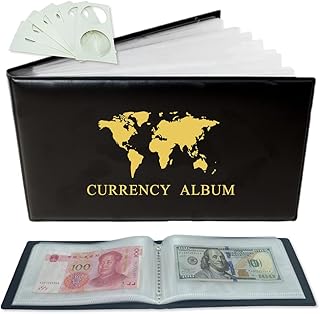

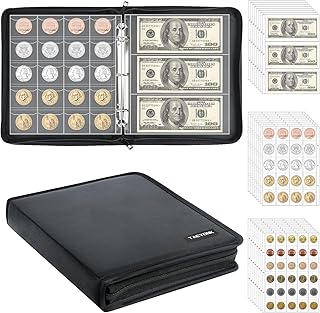

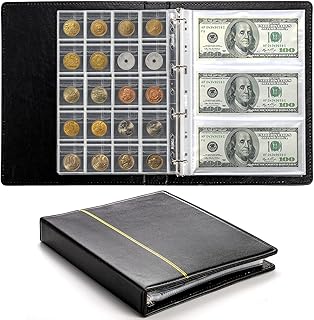

Explore related products

What You'll Learn

- Build genuine relationships - Focus on mutual value, not just transactions, to foster trust and opportunities

- Communicate clearly - State your needs professionally, highlighting benefits for both parties involved

- Follow up gracefully - Use polite reminders without being pushy, showing respect for their time

- Offer solutions - Position your request as a win-win, solving their problem while achieving your goal

- Express gratitude - Always thank them, regardless of the outcome, to maintain a positive connection

Build genuine relationships - Focus on mutual value, not just transactions, to foster trust and opportunities

Chasing money politely isn’t about masking desperation with niceties—it’s about shifting the focus from extraction to contribution. Genuine relationships thrive on mutual value, where both parties perceive a benefit beyond the immediate exchange. Consider the difference between a salesperson who pitches relentlessly and a consultant who listens, understands needs, and offers tailored solutions. The former chases a transaction; the latter builds a foundation for recurring opportunities. This approach requires patience, but it yields dividends in trust, loyalty, and long-term financial stability.

To cultivate such relationships, start by mapping the interests and goals of your counterpart. For instance, if you’re an entrepreneur seeking investment, research the investor’s portfolio and values. Align your pitch with their priorities—whether it’s sustainability, innovation, or market disruption. Use this insight to frame your ask not as a plea for money, but as an invitation to collaborate on a shared vision. For example, instead of saying, “I need funding,” say, “Your expertise in clean energy could help us scale this solution to impact 10,000 households by 2025.” This shifts the dynamic from transactional to transformational.

However, mutual value isn’t just about what you say—it’s about what you do. Consistently deliver on promises, even when there’s no immediate financial gain. For instance, if you’re a freelancer, offer a free resource or insight that solves a client’s problem outside the scope of your project. This generosity fosters goodwill and positions you as a partner, not just a vendor. A study by the Harvard Business Review found that professionals who prioritize relationship-building over short-term gains are 50% more likely to secure repeat business. The key is to view every interaction as an opportunity to add value, not extract it.

One practical strategy is the “3-to-1 rule”: for every ask, provide three instances of value. For example, if you’re chasing an overdue payment, precede your reminder with two helpful updates and one resource that benefits the client. This approach softens the ask and reinforces your commitment to their success. Similarly, in negotiations, frame your requests in terms of shared outcomes rather than personal gain. Instead of saying, “I need a higher commission,” say, “Adjusting the commission structure could incentivize both of us to hit the quarterly target faster.”

Finally, beware the trap of over-transactionalizing relationships. While it’s tempting to quantify every interaction in monetary terms, genuine connections are built on intangible qualities like trust, empathy, and shared purpose. For instance, a mentor who offers candid feedback without expecting immediate reciprocity is more likely to inspire loyalty than one who keeps a mental ledger of favors. By focusing on mutual value, you create a dynamic where money becomes a byproduct of collaboration, not the sole objective. This approach not only makes chasing money polite but also sustainable.

Is Anarchism a Political Ideology? Exploring Its Core Principles and Relevance

You may want to see also

Communicate clearly - State your needs professionally, highlighting benefits for both parties involved

Clear communication is the cornerstone of any successful financial follow-up. When chasing money, ambiguity breeds discomfort and delays. Instead of hinting or beating around the bush, state your needs directly but professionally. For instance, instead of saying, “I was wondering if you’ve had a chance to look into the invoice,” use, “The invoice for [service/product] totaling [amount] is now 15 days past due. Could you confirm the expected payment date by [specific date]?” This approach eliminates guesswork and sets a clear expectation.

Professionalism doesn’t mean coldness; it means framing your request in a way that respects the recipient’s time and position. Start with a polite acknowledgment of their situation, such as, “I understand you’ve been busy with [project/event],” then segue into your need. Follow this with a benefit-driven statement. For example, “Prompt payment ensures we can continue providing [specific service/benefit] without interruption, which supports your [goal/project].” This highlights mutual value, transforming the request from a demand into a collaborative reminder.

A comparative analysis of effective vs. ineffective communication reveals a critical difference: specificity. Vague messages like, “Just checking in on the payment,” often lead to confusion or procrastination. In contrast, a detailed message such as, “The payment of $500 for [service] was due on [date]. Could you process it by [new date] to avoid a 5% late fee and maintain your account in good standing?” provides clarity and urgency. The recipient knows exactly what’s expected and why it matters, reducing the likelihood of follow-up resistance.

To master this approach, follow these steps: First, prepare a concise script that includes the amount, due date, and purpose of the payment. Second, emphasize the shared benefit—how timely payment supports their goals or maintains a positive relationship. Third, end with a call to action, such as, “Please confirm receipt of this message and the payment timeline.” Finally, set a reminder to follow up if you don’t hear back within 48 hours. This structured yet courteous method ensures you’re assertive without being aggressive.

The takeaway is simple: clarity and professionalism aren’t just about politeness—they’re strategic tools. By stating your needs directly and highlighting mutual benefits, you create a win-win scenario. The recipient feels respected, not pressured, and is more likely to respond promptly. This approach not only secures payment but also strengthens the relationship, paving the way for smoother transactions in the future. After all, chasing money politely isn’t just about getting paid—it’s about preserving trust and fostering long-term collaboration.

Deb Haaland's Political Leadership: Impact, Influence, and Legacy Explored

You may want to see also

Follow up gracefully - Use polite reminders without being pushy, showing respect for their time

Chasing money can feel awkward, but following up gracefully is an art that balances persistence with respect. Start by acknowledging the recipient’s time constraints—everyone is busy, and a polite reminder should reflect this awareness. For instance, open with a phrase like, “I know how busy you must be, so I wanted to send a quick reminder about [specific payment or invoice].” This approach softens the request and shows you value their schedule.

The structure of your follow-up matters. Keep it concise—no more than three sentences. Begin with a friendly greeting, state the purpose clearly (e.g., “Just checking in on the status of invoice #12345”), and end with a call to action that offers flexibility (e.g., “Let me know if there’s a better time to discuss this”). Avoid passive-aggressive language or excessive detail, which can come across as pushy. For example, instead of saying, “I’ve sent this three times already,” try, “I wanted to ensure my previous email didn’t get overlooked.”

Timing is critical. Wait at least 7–10 days after the initial request before following up, and space subsequent reminders by 2–3 weeks. Overdoing it can strain the relationship, while underdoing it may signal a lack of urgency. If you’re unsure, err on the side of patience. A well-timed reminder is more effective than a rushed one. For recurring payments, consider setting a schedule for reminders to avoid appearing disorganized.

Finally, personalize your approach. If you’ve built a rapport, a lighthearted comment can ease tension (e.g., “I hope your week is going well—just circling back on [payment]”). For formal relationships, maintain professionalism but add a human touch by expressing gratitude for their attention. Remember, the goal is to nudge without nagging. By showing respect for their time and choosing your words carefully, you can follow up gracefully and increase the likelihood of a positive response.

Is Oliver Anthony Political? Unraveling the Artist's Views and Impact

You may want to see also

Explore related products

Offer solutions - Position your request as a win-win, solving their problem while achieving your goal

Chasing money can feel awkward, but reframing your request as a solution to their problem transforms the dynamic. Instead of demanding payment, position yourself as a partner in resolving their potential challenges. For instance, if a client is late on an invoice, acknowledge the possibility of cash flow issues and propose a payment plan. This approach demonstrates empathy and flexibility, making them more receptive to your request.

Consider this scenario: A freelance designer emails a client about an overdue payment. Instead of a blunt reminder, they write, *"I understand projects can shift priorities. Would it help to split the remaining balance into two installments over the next 30 days? This way, you can manage your budget while ensuring I can continue delivering on our agreed timeline."* This solution-oriented approach addresses the client’s potential financial strain while securing the payment.

The key lies in identifying their underlying concern. Are they overwhelmed with deadlines? Offer to prioritize their project in exchange for prompt payment. Facing unexpected expenses? Propose a discount for early settlement. By aligning your request with their needs, you create a mutually beneficial outcome. Research shows that people are 60% more likely to comply with a request when it’s framed as solving their problem rather than merely benefiting the requester.

However, avoid over-accommodating. Clearly define the terms of your solution to prevent scope creep or further delays. For example, if offering a payment plan, specify the exact dates and amounts. Tools like payment links or automated reminders can streamline the process, ensuring both parties stay on track.

In essence, offering solutions shifts the conversation from confrontation to collaboration. It’s not about conceding your goal but about presenting a pathway that respects their circumstances while achieving your objective. This approach not only secures payment but also strengthens the relationship, paving the way for future partnerships.

Is AHS Cult a Political Statement? Analyzing Themes and Messages

You may want to see also

Express gratitude - Always thank them, regardless of the outcome, to maintain a positive connection

Gratitude is a powerful tool in any communication, especially when it comes to chasing money. Whether you're following up on an invoice, requesting a donation, or negotiating a payment plan, expressing thanks can significantly influence the outcome. It’s not just about saying "thank you" at the end of an email; it’s about weaving genuine appreciation into your message to create a positive and memorable interaction. For instance, instead of a generic "Thanks for your time," try something specific like, "I truly appreciate your attention to this matter—it means a lot to our team." This approach humanizes the request and fosters goodwill.

The psychology behind gratitude is straightforward: people are more inclined to respond favorably when they feel valued. A study by the University of New South Wales found that expressing gratitude in business communications increased the likelihood of a positive response by up to 25%. When chasing money, this could mean the difference between a prompt payment and a delayed one. For example, if you’re following up on an overdue invoice, a message like, "Thank you for your continued partnership—we’re grateful for your business and look forward to resolving this together," shifts the tone from confrontational to collaborative.

However, gratitude must be authentic to be effective. Overuse or insincerity can backfire, making your request seem manipulative. To avoid this, tailor your gratitude to the context. If you’re reaching out to a long-term client, acknowledge their loyalty: "We’re so thankful for your support over the years—it’s clients like you who make our work meaningful." For new contacts, focus on the opportunity: "Thank you for considering our proposal—we’re excited about the potential to work together." This specificity ensures your gratitude feels genuine, not formulaic.

Practical tips can further enhance the impact of your gratitude. First, timing matters. Express thanks at the beginning and end of your communication to frame the request positively. Second, pair gratitude with a clear call to action. For instance, "Thank you for reviewing this—could you confirm receipt by [date]?" combines appreciation with a specific ask. Finally, follow up with gratitude even if the outcome isn’t in your favor. A message like, "Thank you for taking the time to consider this—I understand your decision and appreciate your honesty," leaves the door open for future interactions.

In essence, gratitude isn’t just a courtesy—it’s a strategic element of polite money-chasing. By expressing genuine thanks, you humanize your request, build rapport, and increase the likelihood of a positive response. Remember, the goal isn’t to manipulate but to foster a connection that benefits both parties. Done right, gratitude transforms a potentially awkward conversation into an opportunity to strengthen relationships, even when the financial outcome is uncertain.

Uninformed Electorate: Assessing Political Knowledge Gaps in America

You may want to see also

Frequently asked questions

Use a friendly and professional tone, such as, "Hi [Name], I hope you’re doing well. I wanted to check if you’ve had a chance to review the invoice I sent on [date]. Let me know if there’s anything I can assist with!"

Send a polite reminder email, like, "Hi [Name], just a friendly reminder about the invoice due on [date]. Please let me know if there’s a preferred timeline for payment or if you need further assistance."

Follow up every 7–10 days after the due date, starting with a gentle reminder, then escalating to a firmer tone if necessary, while remaining professional and courteous.

Use phrases like, "I’d appreciate your attention to this matter as soon as possible," or "To avoid any delays, could you kindly process the payment by [date]?"