The concept of an optimal currency area (OCA) is a geopolitical area where a single currency provides the best balance of economies of scale and macroeconomic policy effectiveness to promote growth and stability. The OCA theory was first introduced by Robert Mundell in the 1960s and has since been a subject of debate, especially in the context of the Eurozone. While the Eurozone has brought benefits such as increased trade within Europe, it has also faced challenges like the Greek debt crisis, leading to discussions on whether it constitutes an optimal currency area. Some economists argue that the Eurozone does not meet the criteria for an OCA due to factors like insufficient labour mobility and the inability of member states to direct fiscal and monetary policy interventions. However, others disagree, stating that no country or group of countries represents a perfect OCA, and that fiscal, social, and regulatory policies can be used to overcome these challenges.

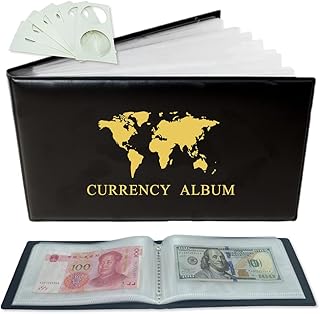

Explore related products

$6.99

Labour mobility

According to Robert Mundell, the economist who developed the theory of OCA, labour mobility can be eased by lowering administrative barriers such as visa-free travel, cultural barriers such as different languages, and institutional barriers such as restrictions on the remittance of pensions or government benefits.

Europe does not have complete labour mobility, but the gains from a common currency in Europe are argued to be sufficient to overcome any disadvantages arising from insufficient labour mobility. However, labour mobility and the speed of labour market adjustment are lower in Europe than in the United States, suggesting that Europe is further from the ideal of an OCA.

The introduction of the euro as a common currency across European nations was a primary test of the OCA theory. While the Eurozone has seen many benefits from the introduction of the euro, it has also experienced problems such as the Greek debt crisis. The long-term outcome of a monetary union under the theory of OCAs remains a subject of debate.

James Madison: Constitution's Father, Why?

You may want to see also

Economic shocks

An optimal currency area (OCA) is a geopolitical area in which a single currency provides the best balance of economies of scale and macroeconomic policy effectiveness to promote growth and stability. The OCA theory was first proposed by Canadian economist Robert Mundell in the 1960s. According to Mundell, one of the main criteria for an OCA is that regions within the area are affected symmetrically by economic shocks.

The Eurozone, as a currency union, has experienced both benefits and problems since the introduction of the euro as a common currency. On the one hand, empirical analyses suggest that the single currency has increased intra-European trade by 5 to 15%. On the other hand, the Eurozone has faced challenges such as the Greek debt crisis and the European sovereign debt crisis, which have raised questions about whether the Eurozone constitutes an optimal currency area.

One argument against the Eurozone as an OCA is the lack of stabilization transfers within the union. Unlike the United States, which has a central federal fiscal authority that provides offsetting transfers when a state's GDP drops, the Eurozone and the EU lack similar mechanisms to smooth out regional economic disturbances. This absence of fiscal federalism can make it challenging to cope with economic shocks.

Another factor to consider is labour mobility. High labour mobility is a criterion for an OCA as it allows for the free flow of labour across regions, helping to mitigate the impact of economic shocks. However, labour mobility in Europe remains lower than in the United States, and even within single countries, complete labour mobility is rare. While some argue that the gains from a common currency in Europe outweigh the disadvantages arising from insufficient labour mobility, others attribute the Eurozone's economic difficulties to its failure to meet the OCA criteria, including the lack of labour mobility.

In conclusion, while the Eurozone has seen increased trade and other benefits from the adoption of the euro, it has also faced economic shocks that have highlighted potential shortcomings as an optimal currency area. The lack of stabilization transfers and the challenge of insufficient labour mobility are factors that may impact the Eurozone's ability to meet the OCA criteria, particularly in terms of symmetric responses to economic shocks.

What Are Filtration Membranes Made Of?

You may want to see also

Monetary policy

The introduction of the euro as a common currency across European nations put the OCA theory to its first major test. While the eurozone has benefited from the euro in many ways, it has also faced challenges such as the Greek debt crisis. This has led to a debate about whether the long-term outcome of a monetary union under the OCA theory will be successful.

One of the key aspects of an optimal currency area is the symmetry of shocks, which Europe scores well on. This means that disturbances such as economic downturns or booms affect the regions within the area symmetrically or similarly. When countries within a currency union have similar business cycles, a shared central bank can effectively promote growth during downturns and manage inflation during booms.

However, one of the challenges of the eurozone is the lack of labour mobility across the region. Labour mobility is an important factor in an optimal currency area as it allows workers to move between regions to find employment when shocks make workers in one region redundant. While complete labour mobility is unlikely to be achieved even within single countries, lowering administrative, cultural, and institutional barriers can help improve labour mobility.

Another challenge for the eurozone is the absence of stabilization transfers. Unlike the United States, which has a central federal fiscal authority that provides stabilization transfers to states in recession, the eurozone and the EU lack such mechanisms. This limits their ability to smooth out regional economic disturbances through fiscal federalism.

The impact of the eurozone on trade within the region has also been significant. Intra-European trade has increased due to the common currency, with early empirical analyses suggesting a 5 to 15% increase in trade within the eurozone compared to trade between non-euro countries. This increase in trade contributes to the argument that the eurozone constitutes an optimal currency area.

In conclusion, while the eurozone exhibits some characteristics of an optimal currency area, such as the symmetry of shocks and increased intra-European trade, it also faces challenges in terms of labour mobility and the absence of stabilization transfers. The success of the eurozone as an optimal currency area remains a subject of debate among economists.

Commander in Chief: A Constitutional Conundrum

You may want to see also

Explore related products

Fiscal transfers

The Eurozone's economic difficulties have been attributed to its failure to meet the criteria for an optimal currency area (OCA). An OCA is a geopolitical area where a single currency provides the best balance of economies of scale and macroeconomic policy effectiveness to promote growth and stability. Robert Mundell, who introduced the concept in the 1960s, outlined four criteria for a successful OCA: high labour mobility, symmetry of shocks, capital mobility, and price and wage flexibility.

One of the key issues with the Eurozone as an OCA is the lack of fiscal transfers. Theoretically, the Stability and Growth Pact includes a "no-bailout" clause, restricting fiscal transfers among member states. However, during the 2010 Eurozone crisis, this clause was abandoned. Fiscal transfers are essential for risk-sharing and stabilizing regional economic disturbances. For example, the US has stabilization transfers, where a drop in a state's GDP is offset by federal fiscal authority transfers.

The absence of fiscal federalism in the Eurozone and EU means they cannot rely on this mechanism to smooth out economic disturbances. This is particularly challenging during recessions or when one country experiences a boom while others do not. While some argue that the EU's crisis may push it towards more federal powers in fiscal policy, the lack of fiscal transfers remains a critical issue in the debate around the Eurozone as an OCA.

Furthermore, the Eurozone's introduction has resulted in a loss of individual countries' ability to implement fiscal and monetary policy interventions to stabilize their economies. This loss of autonomy can make it challenging for countries to respond effectively to economic shocks and recessions.

Despite these challenges, some argue that no country or group of countries represents a perfect OCA. Waltraud Schelkle, an Associate Professor of Political Economy, contends that countries can use fiscal, social, and regulatory policies to address these issues. She highlights that even the US, often held as a model for monetary integration, faced challenges during the 19th century with the introduction of the dollar.

British Constitution: Colonial Australia's Legal Framework?

You may want to see also

Business cycles

The Eurozone, as a currency union, has experienced challenges in this regard. While intra-European trade has increased since the introduction of the euro, there have also been significant business cycle divergences among the regions. Between 1992 and 2005, 46 out of 59 Eurozone regions experienced a decline in alignment with the European business cycle, indicating a growing divergence. This contradicts the predictions of the European Commission View, which associates economic integration with tighter synchronization of business cycles.

The lack of convergence in business cycles within the Eurozone has implications for monetary policy. When countries within a currency union experience asynchronous business cycles, a uniform monetary policy can have unintended consequences. It may be counter-cyclical for some countries, exacerbating their economic challenges, while being pro-cyclical in others, intensifying existing economic trends.

Additionally, the Eurozone's vulnerability to asymmetric shocks, such as the financial crisis of 2007-2008, has highlighted the challenges of having a single currency without sufficient economic integration. The eurozone crisis, which included the Greek debt crisis, revealed that European countries may not have been sufficiently integrated to benefit fully from a common currency, as predicted by Mundell's theory of OCA.

Furthermore, the absence of stabilization transfers within the Eurozone and the European Union (EU) limits their ability to smooth out regional economic disturbances. Unlike the United States, which has stabilization transfers to offset losses in state GDP, the Eurozone and the EU lack similar mechanisms. This further contributes to the challenges of managing business cycle divergences within the Eurozone.

America's Founding: Independence or Constitution?

You may want to see also

Frequently asked questions

An OCA is a geographic area in which a single currency would create the greatest economic benefit. Countries that share strong economic ties may benefit from a common currency, allowing for closer integration of capital markets and facilitating trade.

Canadian economist Robert Mundell outlined the following criteria for an OCA: high labour mobility throughout the area, easing labour mobility by lowering administrative, cultural, and institutional barriers, and symmetry of shocks.

There is debate on this topic. Some economists argue that the Eurozone is not an OCA, citing issues such as the Greek debt crisis and the European sovereign debt crisis as evidence. Others, like Waltraud Schelkle, argue that no country or group of countries represents an OCA and that fiscal, social, and regulatory policies can be used to overcome difficulties. The Eurozone has seen benefits from the introduction of the euro, but it has also experienced economic difficulties, and there is a lack of stabilization transfers to smooth out regional economic disturbances.