In the United States, corporations are prohibited from using their treasuries to make direct contributions to federal candidates and national political parties. However, corporations may donate appreciated stock to political organizations classified under Section 527 of the Internal Revenue Code. These 527 groups are devoted to election-related activities and may engage in independent spending, but they must disclose their donors to the IRS. Additionally, corporations can give unlimited sums to trade associations organized under Section 501(c)(6) of the Internal Revenue Code, which are tax-exempt and can engage in election-related activities without disclosing their donors.

Characteristics and Values

| Characteristics | Values |

|---|---|

| Unincorporated tribal entities | Can be considered a "person" under the Federal Election Campaign Act and are subject to contribution prohibitions and limitations |

| Party committees | Can support federal candidates by making contributions |

| SSFs | Can make contributions to candidates and their authorized committees |

| Nonconnected PACs | Can make contributions to influence federal elections, subject to the Act's limitations and reporting requirements |

| Super PACs and Hybrid PACs | Cannot make contributions to candidates |

| Individuals | Can make contributions to party committees, subject to limits |

| Minors | Can make contributions to party committees, subject to limits, if the decision is made knowingly and voluntarily by the minor, and the funds, goods, or services contributed are owned or controlled by the minor |

| Incorporated charitable organizations | Prohibited from making contributions in connection with federal elections |

| Federal government contractors | Cannot contribute to campaigns |

| Foreign nationals | Cannot make contributions in connection with any federal, state, or local election |

| Individuals who have already contributed the maximum amount | Cannot give money to another person to contribute to the same candidate |

| Trusts | May make contributions as long as the beneficial owner has control over the use of the funds and the contribution is reported as coming from the beneficial owner |

| LLCs | Treated as either a corporation or a partnership for contribution purposes |

| Corporations | Prohibited from using corporate treasuries for direct contributions to federal candidates and national political parties, but may donate directly to state and local candidates, parties, and committees within certain limits |

| Tax-exempt political committees | Corporations may contribute, but must disclose their donors to the IRS |

| Trade associations | Can receive unlimited sums from corporations, but corporate funds used for election-related activity are non-deductible for tax purposes |

Explore related products

What You'll Learn

- Corporations can donate to state and local candidates, parties, and committees

- Individuals can make contributions to party committees

- Political committees cannot accept prohibited contributions

- Super PACs and Hybrid PACs do not make contributions to candidates

- Charities face restrictions on political activity

Corporations can donate to state and local candidates, parties, and committees

In the United States, corporations are prohibited from using their treasuries to make direct contributions to federal candidates and national political parties. However, they are allowed to donate to state and local candidates, parties, and committees within certain limits. These state-level contributions must be disclosed and can be found on state campaign finance databases.

Corporations can also give to tax-exempt political committees organized under Section 527 of the Internal Revenue Code, also known as 527 groups. These groups are dedicated to election-related activities and may make independent expenditures, but they must disclose their donors to the IRS. Additionally, corporations may use their treasury funds for direct independent expenditures.

It is important to note that certain restrictions apply to incorporated charitable organizations. While they are generally prohibited from making contributions in connection with federal elections, charities face additional restrictions on political activity under the Internal Revenue Code provisions. Campaigns are not permitted to accept or solicit contributions from federal government contractors. Federal law also prohibits contributions, donations, expenditures, and disbursements connected to federal, state, or local elections from being solicited, directed, received, or made by or from foreign nationals.

Furthermore, a corporation or labor organization is prohibited from reimbursing individuals who make contributions to a political committee. This includes bonuses, expense accounts, or other forms of direct or indirect compensation. An extension of credit to a political committee by an incorporated commercial vendor is also considered a prohibited contribution unless specific conditions are met.

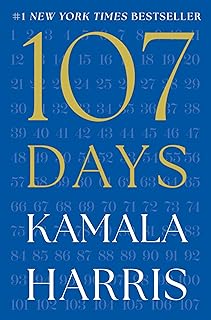

Join Kamala Harris' Campaign: Steps to Take Now

You may want to see also

Individuals can make contributions to party committees

There are also rules regarding trusts. Contributions from trusts are allowed, but only if the beneficial owner of the trust has control over the use of the funds. The contribution should be reported as coming from the beneficial owner, and not the trust. Additionally, special requirements apply to contributions from trusts to presidential campaigns that are eligible for federal matching payments.

Corporations and labour organizations are prohibited from making contributions in connection with federal elections. However, they may contribute to independent expenditure-only committees (Super PACs) and non-contribution accounts maintained by Hybrid PACs. They may also pay the expenses of setting up, administering, and soliciting contributions for their own political committee, known as a separate segregated fund (SSF or PAC).

State-level candidate, party, and committee contributions have varying disclosure requirements and can be found on state campaign finance databases. Corporations may donate directly to state and local candidates, parties, and committees within certain limits. They may also give to tax-exempt political committees organized under Section 527 of the Internal Revenue Code, or 527 groups. These groups are dedicated to election-related activities and may make independent expenditures, but their donors must be disclosed to the IRS.

The Politician Who Responded to Every Mail Message

You may want to see also

Political committees cannot accept prohibited contributions

Political committees are subject to strict regulations regarding the contributions they can accept. The Federal Election Campaign Act prohibits political committees from accepting certain types of contributions. These restrictions are in place to prevent undue influence and ensure fair and transparent political processes.

Firstly, it is important to note that political committees cannot accept contributions from prohibited sources, which include corporations and labor organizations. This prohibition extends to nonprofit corporations, with the exception of funds from a corporate separate segregated fund. Additionally, labor organizations are also restricted, unless the funds originate from a separate segregated fund. These restrictions apply to all incorporated organizations, except for political committees that incorporate solely for liability purposes.

Political committees must also be cautious when accepting contributions from trusts. They can only accept contributions from trusts if no member of the political committee serves as a trustee or exercises control over the undistributed trust corpus or interest amount. In such cases, the committee must disclose both the trust's and the decedent's names in its report. Furthermore, contributions from living (inter vivos) trusts are permissible as long as the trust's beneficial owner maintains control over the use of the funds. These contributions should be reported as coming from the beneficial owner rather than the trust itself.

Additionally, political committees must be vigilant about contributions from minors. Minors under the age of 18 can contribute to political committees, but only if the decision is made voluntarily and independently, and the funds, goods, or services contributed are owned or controlled by the minor. Moreover, the contribution must not be funded by a gift given to the minor for the purpose of making the contribution, nor can it be influenced by another individual.

Political committees also need to be aware of the limitations and reporting requirements for contributions from Super PACs and Hybrid PACs. While these committees can accept unlimited contributions from individuals, corporations, and labor organizations, they do not make contributions to specific candidates. Instead, they focus on influencing federal elections and must adhere to the Federal Election Campaign Act's regulations.

Donate to Harris: Campaign Contribution Options and Methods

You may want to see also

Explore related products

$0.99

Super PACs and Hybrid PACs do not make contributions to candidates

In the United States, political campaigns are funded by a variety of sources, including individual donors, political action committees (PACs), and super PACs. While individuals and traditional PACs can donate directly to political campaigns, Super PACs and Hybrid PACs are prohibited from doing so.

Super PACs and Hybrid PACs are a type of political committee that can raise and spend unlimited amounts of money from corporations and individuals. However, they are not allowed to donate directly to political campaigns or coordinate with candidates. This is because they are considered nonconnected committees, which means they are not officially affiliated with a political party or candidate.

The Federal Election Commission (FEC) has specific rules and regulations regarding Super PACs and Hybrid PACs. These committees are allowed to accept unlimited contributions from individuals, corporations, labor organizations, and other political committees. However, they cannot accept contributions from foreign nationals, federal contractors, national banks, or federally chartered corporations.

While Super PACs and Hybrid PACs cannot contribute directly to candidates, they can still have a significant impact on political campaigns. They can use the funds they raise to create ads, organize events, and promote their preferred candidates or policies. This allows them to influence public opinion and shape the political landscape without officially coordinating with any specific candidate.

It's important to note that campaign finance laws and regulations are complex and constantly evolving. While Super PACs and Hybrid PACs do not make direct contributions to candidates, there have been instances where these committees have found ways to circumvent the rules and coordinate with campaigns indirectly. As a result, there are ongoing efforts to strengthen transparency and anti-corruption measures in campaign financing.

Harris' Election Prospects: Can She Win?

You may want to see also

Charities face restrictions on political activity

Charities are prohibited from making contributions in connection with federal elections. Charities face additional restrictions on political activity under provisions of the Internal Revenue Code. This includes a ban on political campaign activity, which was created by Congress more than 50 years ago.

The Internal Revenue Service (IRS) has the authority to enforce these laws, which apply to 501(c)(3) organizations, including charities and churches. This means that charities are prohibited from directly or indirectly participating in, or intervening in, any political campaign on behalf of or in opposition to any candidate for elective public office. This prohibition includes contributions to political campaign funds and public statements of position made on behalf of the organization.

Violating this prohibition can result in the denial or revocation of tax-exempt status and the imposition of excise taxes. However, certain activities, such as non-partisan voter education and registration activities, are not considered prohibited political campaign activity. Charitable nonprofits are permitted to engage in advocacy, lobbying, and legislative activities, as long as they do not expend more than an "insubstantial" amount of resources on lobbying.

Additionally, if a candidate for public office wishes to speak at a charitable function, the nonprofit should only agree if the candidate will not discuss their campaign and if other candidates are also invited.

Corporate Money in Politics: Who Benefits?

You may want to see also

Frequently asked questions

Yes, individuals can donate appreciated stock to political campaigns. However, corporations are prohibited from using their treasuries for direct contributions to federal candidates and national parties.

There are no specific limits mentioned for stock donations. However, individuals under 18 can contribute to party committees, provided the decision is made voluntarily and the funds are owned or controlled by the minor.

Yes, corporations can donate stock to state and local candidates, parties, and committees within certain limits. These contributions must be disclosed and can be found on state campaign finance databases.

No, federal law prohibits contributions, donations, expenditures, and disbursements made directly or indirectly by foreign nationals in connection with any federal, state, or local election.

Yes, a political campaign can accept stock donations from a living (inter vivos) trust as long as the beneficial owner of the trust has control over the use of the funds. The donation should be reported as a contribution from the beneficial owner.