Political donations are a highly scrutinized aspect of the electoral process, with strict regulations in place regarding who can contribute and the amounts they can donate. Federal law in the US requires the disclosure of donations exceeding $200, including the donor's name, address, occupation, and employer information, which then becomes a matter of public record. This raises the question of whether employers can access this information and potentially influence their employees' political contributions. While employers may require pre-approval for political donations, they cannot directly or indirectly affect an individual's employment based on their political contributions, as this would violate applicable labor laws.

Can employers see if I donated to a political campaign?

| Characteristics | Values |

|---|---|

| Can employers see donations? | Yes, if the donation is over $200, as federal law requires disclosure of most significant contributions over this amount. This includes donors' names, addresses, occupations, and employer information, which then becomes a public record tracked by the FEC. |

| Can employers restrict donations? | Yes, employers may require employees to seek preapproval before making personal political contributions. This is due to the potential for loss of government contracts, fines, and a ban on future contracts if pay-to-play laws are violated. |

| Can employers accept donations? | No, if the employer is a corporation, federal government contractor, or another prohibited source, the excess payment would be prohibited under the regulations applicable to that employer. Charities also face additional restrictions on political activity. |

Explore related products

What You'll Learn

Employers may require preapproval for employee donations

In the United States, federal law requires the disclosure of most significant contributions over $200. This includes donors' names, addresses, occupations, and employer information, which then become a matter of public record, freely available and tracked by the FEC.

While an employer cannot directly or indirectly affect an individual’s employment by means of discrimination or threat of discrimination based on the individual’s personal political contributions, employers may require preapproval for employee donations. This is a result of the increased number of jurisdictions enacting pay-to-play laws. A seemingly innocuous contribution by an employee could result in the loss of government contracts, fines, and a ban on future contracting. By requiring pre-approval, the employer can properly vet the contribution for compliance with a jurisdiction’s pay-to-play law, including disclosure requirements.

It is important to note that various jurisdictions bar employers from retaliating against employees for engaging in political activities, which can include everything from participating in a political rally to making campaign contributions. This means that while an employer may require preapproval for employee donations, they cannot use this information to discriminate against or threaten the employee.

The Federal Election Commission (FEC) maintains a database of individuals who have made contributions to federally registered political committees. This database can be searched by the public using various filters, including the donor's employer. While this information is publicly available, it is important to note that it is not intended to replace or change the law or create any rights for any person.

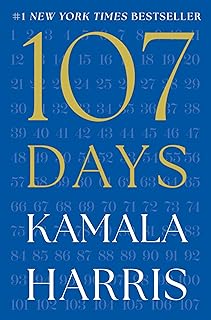

Kamal Harris: Can She Win?

You may want to see also

Federal law prohibits certain donations

However, it is important to note that federal law also prohibits the use of contributor information for commercial purposes or soliciting contributions. Additionally, employers are not allowed to retaliate against employees for engaging in political activities, including making campaign contributions. While employers may require employees to seek preapproval for political contributions, they cannot discriminate or threaten discrimination based on an individual's personal political contributions.

Federal law also prohibits specific sources from making contributions to political campaigns. For example, incorporated charitable organizations, corporations, labor organizations, federal government contractors, and foreign nationals are all prohibited from contributing to federal elections. Additionally, campaigns may not accept or solicit contributions from these prohibited sources.

Furthermore, there are limits on the amount of money individuals and organizations can donate to a political campaign. The FEC enforces the Federal Election Campaign Act of 1971 (FECA), which sets contribution limits for individuals and groups. These limits vary depending on the type of office being sought and the specific regulations in place for that election cycle. It is worth noting that candidates can spend their own personal funds on their campaigns without limits but must report the amount spent to the FEC.

Donors to Kamala: Uncovering the Sources of Campaign Funding

You may want to see also

Limits on direct donations to specific candidates

In the United States, the Federal Election Commission (FEC) is responsible for enforcing laws related to campaign finance. The FEC sets contribution limits for individuals and groups and oversees public funding used in presidential elections. The FEC also maintains a database of individuals who have made contributions to federally registered political committees. This database is searchable by the public and includes information such as the contributor's name, employer, and contribution amount.

There are several restrictions on who can contribute to political campaigns and how much they can contribute. For example, federal law prohibits foreign nationals from making contributions in connection with any federal, state, or local election. Additionally, incorporated charitable organizations are prohibited from making contributions in connection with federal elections, and campaigns may not accept or solicit contributions from federal government contractors.

The Federal Election Campaign Act (FECA) imposes limits on contributions to a candidate's campaign, except for contributions made from a candidate's personal funds. A candidate can spend their own money on their campaign without limits, but they must report the amount they spend to the FEC. The Act also specifies that a campaign is prohibited from retaining contributions that exceed the limits, and special procedures must be followed if a campaign receives excessive contributions.

The Bipartisan Campaign Reform Act (BCRA) increased the contribution limits for individuals giving to federal candidates and political parties, and these limits are updated every two years to account for inflation. There is no longer an aggregate limit on how much an individual can give in total to all candidates, PACs, and party committees combined. However, there are still some restrictions in place. For example, a campaign may not accept more than $100 in cash from a particular source for a campaign for federal office, and anonymous cash contributions are limited to $50.

In terms of contributions from trusts, there are specific requirements. For instance, contributions may be made from a living (inter vivos) trust as long as the trust's beneficial owner has control over the use of the funds. Additionally, party committees may support federal candidates and make contributions, and Super PACs and Hybrid PACs can accept unlimited contributions but do not make contributions to candidates.

Donating to Political Campaigns: Company Ethics and Legality

You may want to see also

Explore related products

Public record of donations over $200

In the United States, the Federal Election Commission (FEC) maintains a publicly accessible database of individuals who have made contributions to federally registered political committees. This database, known as OpenSecrets, is the nation's premier research group for tracking money in U.S. politics and its impact on elections and public policy.

According to federal law and multiple sources, only political donations exceeding $200 are considered part of the public record. Smaller contributions are not included in the database. This threshold applies to donations made directly to political campaigns or through Political Action Committees (PACs), which are organizations that receive contributions from individuals, corporations, and other groups to influence political outcomes.

The OpenSecrets database allows users to search for donors by their first and last name, employer, occupation, location, and contribution amount, among other filters. However, it is important to note that, as per federal law, contributor information cannot be used for soliciting additional contributions or for commercial purposes. Additionally, OpenSecrets does not provide street addresses or phone numbers for contributors.

While the database provides transparency and accountability in political funding, it is worth mentioning that there are exceptions and workarounds to the disclosure requirements. For instance, "dark money" groups spend millions of dollars on elections without revealing the sources of their funding. Nevertheless, the FEC database remains a valuable resource for those interested in researching public records of political donations over $200.

Target's Political Leanings: Which Party Does It Support?

You may want to see also

Donations from minors

In the United States, individuals who are under 18 years old may make contributions to candidates and political committees, subject to certain limitations. These include: the minor making the decision to contribute knowingly and voluntarily; the minor having exclusive ownership or control of the funds, goods, or services contributed; and the contribution not being made from the proceeds of a gift intended for the purpose of providing funds to be contributed, nor being controlled in any way by another individual.

The Federal Election Commission (FEC) maintains a database of individuals who have made contributions to federally registered political committees. This database includes records of receipts from individuals who contribute at least $200 (smaller contributions are not part of the public record). The FEC website allows users to search for individual contributors by their first and/or last name, employer or occupation, city, state, and/or zip code, date of the contribution, and amount of the contribution.

It is important to note that there are various contribution prohibitions and limitations in place. For example, federal law prohibits contributions from foreign nationals, federal government contractors, and incorporated charitable organizations in connection with federal elections. Additionally, a contribution made by one person in another's name is prohibited. This includes a corporation reimbursing employees for their contributions through bonuses or other methods.

Furthermore, contributions from trusts are subject to specific requirements. They must be made from a living (inter vivos) trust, with the trust's beneficial owner having control over the use of the funds. The contribution should be reported as coming from the beneficial owner rather than the trust.

Other entities, such as Super PACs and Hybrid PACs, are considered nonconnected committees that do not make contributions to candidates. Instead, they solicit and accept unlimited contributions from individuals, corporations, and other political committees.

Social Media: Political Campaign's Best Friend

You may want to see also

Frequently asked questions

Yes, employers can see if you donated to a political campaign. Federal law in the US requires the disclosure of contributions over $200, which includes donors' names, addresses, occupations, and employer information. This information is then made freely available to the public and tracked by the FEC (Federal Election Commission).

An employer may require preapproval before you make a personal political contribution. This is to ensure compliance with the jurisdiction's pay-to-play laws and to avoid any legal repercussions, such as the loss of government contracts or fines. However, various jurisdictions bar employers from retaliating against employees for engaging in political activities, and an employer cannot discriminate or threaten discrimination based on an individual's personal political contributions.

Yes, there are restrictions on who can donate to political campaigns. For example, foreign nationals are prohibited from making contributions, and campaigns cannot accept donations from certain organizations and individuals, such as federal government contractors. Additionally, there are limits on the amount that can be donated, with a maximum of $2,800 for contributions to a specific candidate.